Whitehaven Coal (WHC) provided their half-year results for 2025, as expected commodity price falls were offset by a step change in volumes from the new BHP met coal mines. The HNW Portfolios currently holds a 3% weight in WHC.

Key Points:

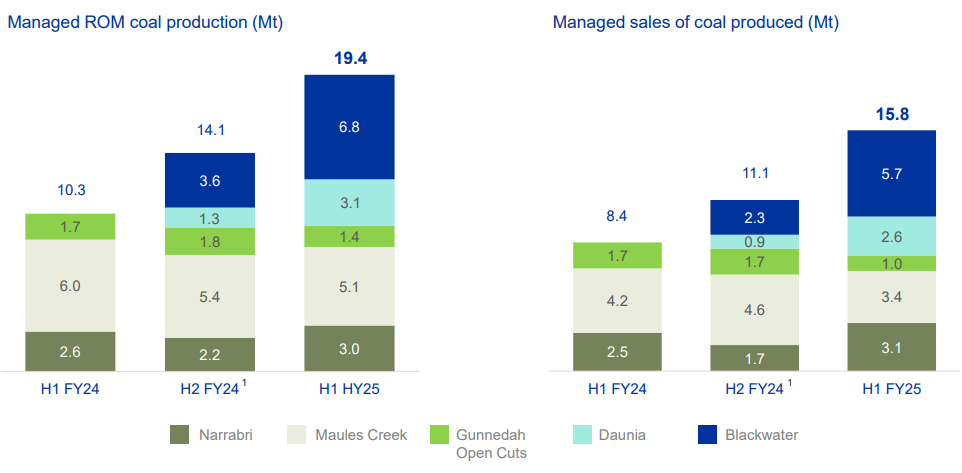

- Profits Down: Whitehaven recorded a 12% fall in profits to $328 million, driven primarily by a fall in thermal coal price, wet weather disrupting production and transaction costs surrounding the acquisition of the Blackwater and Daunia mines. EBITDA was up 54% due to increased tonnes from WHC’s existing and new met coal mines. (See Below).

- Strong Balance Sheet: WHC currently has A$900 million in net debt, representing a gearing ratio of 16%, but following the completion of the sale, Whitehaven will be debt-free in the next half post taxes, and BHP deferred consideration payment.

- Capital Management: The company declared a 9-cent interim divy but has flagged higher dividends at the full year with the debt taken to acquire BHP’s met coal mines paid off.

- Share Buy-back: Following the selldown of Blackwater, WHC is now in a much stronger capital position. With the board unable to increase the dividend payout range until the end of the year, WHC management has given a $75 million share buy-back.

- Why is the stock up?

- Outlook: WHC management reaffirmed full-year guidance, but said that the company was tracking to he upper end of guidance on production and lower end of guidance on costs, which pleased investors.

Portfolio Strategy: Whitehaven has undergone a transformational acquisition, that has seen the business move from a pure thermal coal miner to a combined metallurgical (steel) and thermal coal business. This acquisition from BHP grants Whitehaven access to new mining assets with 50+ years of mine life at a very low price of 1.9 times earnings, and it will see a significant increase in company profits regardless of any downward moves in the coal. Whitehaven thermal coal mines produce one of the highest quality coal exported mainly to Japan, with low ash content, meaning that Whitehaven coal collects a premium to international pricing and that these mines will be the last mines to close down. WHC trades on 5x earnings and a 4% dividend yield based on a 25% payout ratio.

WHC finished up +9% to $5.65 and was the result of the day today