Sonic Healthcare (SHL). This morning, global pathology company SHL reported their first-half profit results, which were very good and better than expected. The HNW Equity Portfolio has a 3.7% weight to Sonic.

Key Points:

- Profits: Profits were up +17% to $237 million, a very solid result driven by Australian pathology, Germany, Switzerland and the UK. The USA was only up slightly due to lower-than-expected growth in anatomical pathology and the rollout of an enhanced revenue collection system. What pleased Atlas was the expanding profit margin and lower labour costs, with SHL executing plans to reduce excess Covid testing headcount.

- Cashflow Strong: operating cash generated up +37% to $620 million on the back of a 103% conversion of EBITDA to cash flow.

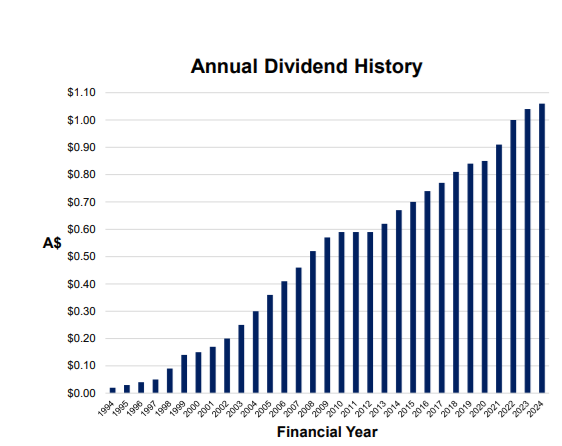

- Dividend: A modest increase of +2% to $0.44 per share in line with SHL’s progressive dividend policy (see below), supported by strong cash generation.

- Continued Balance Sheet Strength: Gearing at 24% with an interest cover ratio (annual profit divided by interest cost) of 11 times, there are no anxious bankers.

- Outlook: Sonic management declined to upgrade their profit guidance of 10% growth in 2024. This looks overly conservative in light of a robust first half and a reported strong start to 2025.

Portfolio Strategy: Sonic and CSL represent the core healthcare positions in the Portfolio. SHL exposes us to the rising demand for medical testing, exacerbated by new medical technologies, an aging population, and doctors’ desire to cover themselves against malpractice claims by increasing the number of tests ordered. SHL is one of the largest global patient testing companies with a significant market share in Australia, Germany, the UK, and the USA, and it will benefit from a falling AUD. Unlike drug companies or device companies such as Cochlear, SHL has an industrial process of blood and tissue sample testing that benefits from economies of scale and not the hundreds of millions of dollars invested in R&D to develop the next wonder drug device.

In the medium term, SHL will benefit from an older and sicker population, and doctors will schedule more tests to avoid malpractice suits, particularly in the USA, where SHL is now the third largest pathology company. Unlike many companies splashing around AI this reporting season with often dubious connections to their business, SHL is likely to see significant benefits from digital pathology and AI. The company has made substantial investments in this area in the past two years, starting with a prognostic AI algorithm for melanoma.

SHL finished down -2.7% % to $28.05 – a curious move in light of a solid result