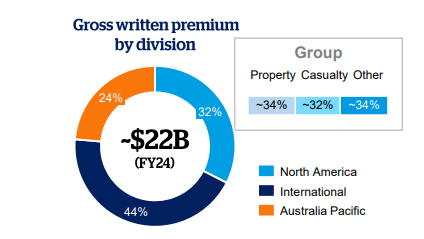

QBE Insurance (QBE) The global insurer released its full-year 2024 profit results, which showed the results of a long-term strategy to reduce volatility and complexity in the business. In general, the company benefits from continuing positive trends in the insurance industry. The HNW Portfolios both have a 5% weight to QBE.

Key Points:

- Record Profits: QBE’s net profit was up +27% to US$1.7 billion, driven by a 6% increase in premium rates and a 3% in premium volumes. It was pleasing to see QBE keep costs under control whilst growing volumes due to lower-than-average catastrophe claims as QBE continued to lower the risk exposure of the insurance book, adding to profit growth. The highlight for us was the turnaround in the USA, which posted its best result in years, reflecting disciplined underwriting and exiting loss-making insurance lines.

- Investment Float higher interest rates = good times: The net return on QBE’s US$31 billion investment float was $1.5 billion, representing a return of 4.9%. This is around US$1 billion more than QBE earned on its investment float only two years ago.

- Strong Balance Sheet: The balance sheet remains in good shape, with their regulatory capital above the top end of the range at 1.76x (1.6-1.8x) and gearing well within their target range at 25%.

- Large Increase in the Dividend: Up +40% to $A0.87 per share (20% franked), representing a payout ratio of 50% with the falling AUD helping. The call management indicated that investors could see a share buyback if we see another low volume of catastrophes next year.

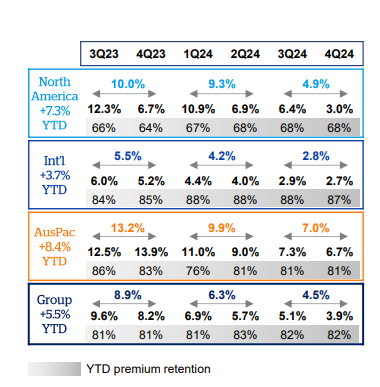

- Outlook: Management expects mid-single-digit revenue growth driven by a 3% increase in premium rates and a 3% growth in insurance volumes. In combination with existing non-profitable insurance segments, QBE profits will remain strong. QBE was not impacted by the recent Californian wildfires, exiting coverage in the state in 2023. However, losses incurred by other insurers in California will put upward pressure on insurance premiums around the USA

- Why is the stock up? This is a solid result from Australia’s only global insurer (see below). QBE spent close to a decade in the investing doghouse from 2011-23 due to poor pre-GFC era acquisitions and near-zero interest rates; 2024 showed a clean result with all three divisions performing well, further breaking down investor hatred toward the stock.

Portfolio Strategy: QBE has a diverse class of insurance business lines across Australia, Asia, Europe, and America, and it gives the portfolio exposure to both falling AUD, rising interest rates, and a hardening of insurance pricing. This result shows the benefits of the simplification drive over the past five years. QBE has jettisoned exotic businesses such as Argentinian workers comp, Columbian third-party motor, and Ecuadorian crop insurance acquired during QBE’s growth at all costs phase 15 years ago. QBE is managing inflation well by pushing through premium increases (see chart below) and is benefiting from rising rates. QBE trades on a forward PE of 11x with a 5% yield based on a 60% payout ratio.

QBE finished up +3% to $20.68