This morning, Woodside (WDS) reported their half-year 2024 results, which came in above market expectations, helped by strong production at their new Sangomar project in Senegal. The HNW Growth portfolio has a 5% allocation to WDS, while the Income Portfolio has a 7.25% allocation to WDS.

Key Points:

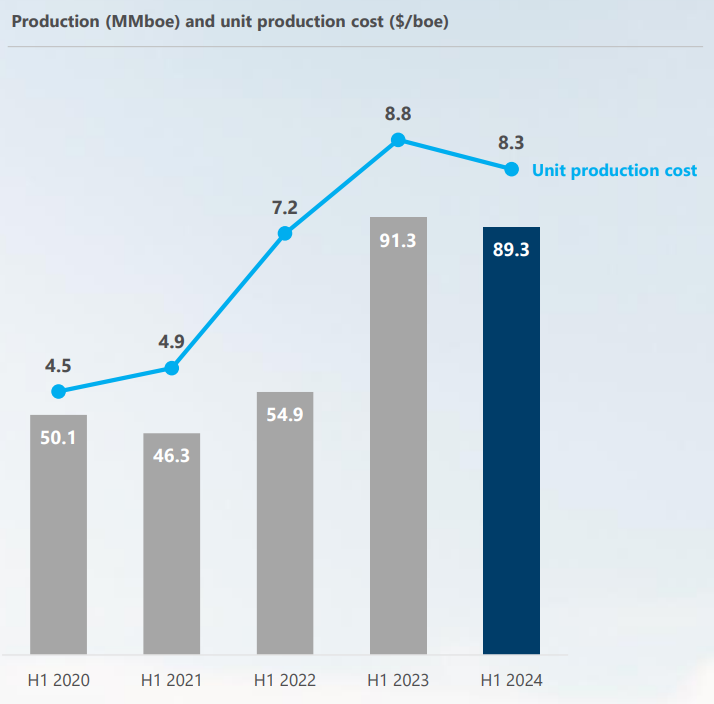

- Profits Up: Net profits of US$1.9 billion, representing an increase of 11% on last year, driven by near high production, but primarily by lower unit costs to US$8.30 a barrel, down from US$8.80 a barrel last year, a pretty good outcome. (See Below)

- More Growth Coming: During the half, WDS achieved its first oil at its Sangomar project in Senegal, ramping up to 100,000 barrels of oil daily to Woodside’s portfolio. In addition, WDS is still on schedule to deliver its Scarborough project in 2026, the Trion project in the Gulf of Mexico in 2028, and the two recent M&A targets of Tellurium LNG Terminal and OCI Clean ammonia project.

- Strong Balance Sheet: Woodside maintains an extremely strong balance sheet, with 13% gearing below the midpoint of their target range of 10-20% gearing. This is very impressive when the company has heavily reinvested within itself for expansions whilst distributing high amounts of dividends. WDS’ balance sheet reflects moves to de-risk projects by selling down minority stakes in projects to customers combining with offtake agreements such as the 25% sale of Scarborough LNG to two Japanese utilities for US$2.4 billion over the last year.

- Dividends Down: WDS announced an interim dividend of $1.02 per share, representing an 80% payout of profits.

- Why is the stock up?: Dividend higher per share with many expecting a big dividend cut due to growth projects and recent investments in the USA. What we liked was management clearly stating there “no change to dividend policy” and that the company had “continued capacity to pay strong dividends”, selling down stakes in assets to maintain cash flows to shareholders. WDS mentioned that they had received a number of offers to buy a stake in the Texas Ammonia and Driftwood LNG projects.

- Guidance: WDS reconfirmed that they expect to produce 185-195 million barrels of oil, or a 10% lift in the second half of 2024.

Portfolio Strategy: WDS is the Portfolio’s sole energy exposure and is the most conservative and well-managed Australian oil company. WDS has the lowest production cost and gearing, an essential position for an energy company as conditions are not always as sunny. We see that WDS’ producing assets located on the Northwest Shelf of WA and the Gulf of Mexico are undervalued. Their high strategic value in the event of a wider Middle East conflict is recognised by Japanese and Korean utilities but not by Australian investors. The company trades on an undemanding PE of 12x with a 7% yield.

Woodside finished up 4% to $27.42