Sonic Healthcare (SHL). This morning, global pathology company SHL reported their 2024 profit results, which were in line with expectations. The HNW Growth Portfolio has a 2% weight to Sonic.

Key Points:

- Profits: Full profits were down to $511 million as very high-margin (85% profit margin paid for by price-insensitive governments) Covid testing rolled off the sales book. FY24 was the first year to show a slowing down of PCR testing, which has offered rivers of gold for SHL. SHL has played Covid well, using the super normal profits to pay down debt and expand the business in the USA and Europe.

- Base Business Strong: What was pleasing to see was that the base pathology testing business performed well, with revenue growing by 16% to $8.9 billion. This was supported by strong growth across all regions, particularly in Australia, Germany, Switzerland and the US. This growth is why we own Sonic, and since FY 2019, the company has added $2.7 billion in annual revenue or another $600 million in profits via organic growth and acquisitions.

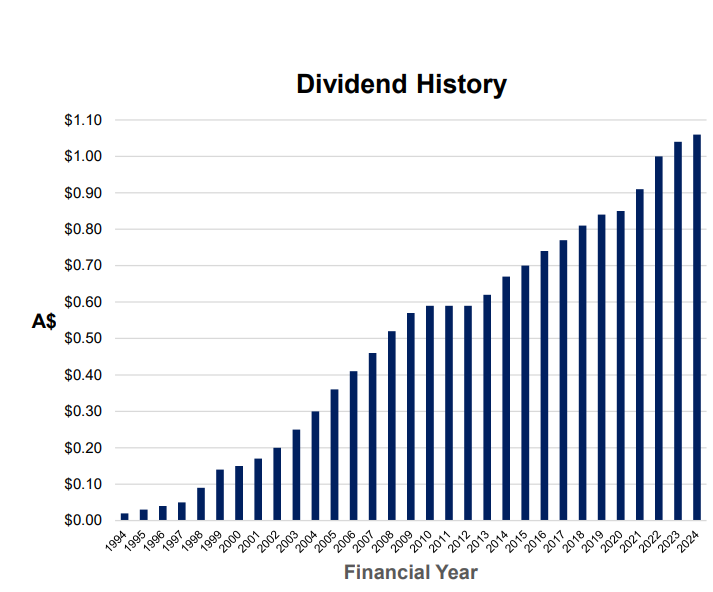

- Dividend: A modest increase of +2% to $1.06 per share in line with SHL’s progressive dividend policy (see below), supported by strong cash generation.

- Continued Balance Sheet Strength: Gearing at 22% with an interest cover ratio (annual profit divided by interest cost) of 12 times, there are no anxious bankers.

- Outlook: Sonic management reaffirmed their guidance of FY24 EBITDA between $1.7-1.8 billion, reflecting a 10% increase on FY24 with the base business performance performing well.

SHL finished up +1% to $25.97.

Portfolio Strategy: Sonic and CSL represent the core healthcare positions in the Portfolio. SHL exposes us to the rising demand for medical testing, exacerbated by new medical technologies, an aging population, and doctors’ desire to cover themselves against malpractice claims by increasing the number of tests being ordered. SHL is one of the largest global patient testing companies with a significant market share in Australia, Germany, the UK and the USA and will benefit from a falling AUD. Unlike drug companies or device companies such as Cochlear, SHL has an industrial process of blood and tissue sample testing that benefits from economies of scale and not the hundreds of millions of dollars invested in R&D to develop the next wonder drug device.

In the medium term, SHL will benefit from an older and sicker population, and doctors will schedule more tests to avoid malpractice suits, particularly in the USA, where SHL is now the third largest pathology company. Unlike many companies splashing around AI this reporting season with often dubious connections to their business, SHL is likely to see significant benefits from digital pathology and AI. The company has made substantial investments in this area in the past two years, starting with a prognostic AI algorithm for melanoma.