This morning, Whitehaven Coal (WHC) provided their full-year results following the transformational year in which they took ownership of two metallurgical coal mines from BHP. The HNW Growth Portfolio currently holds a 3% weight in WHC, but in light of today’s result the HNW IC may look to add it to the Income Portfolios.

Key Points:

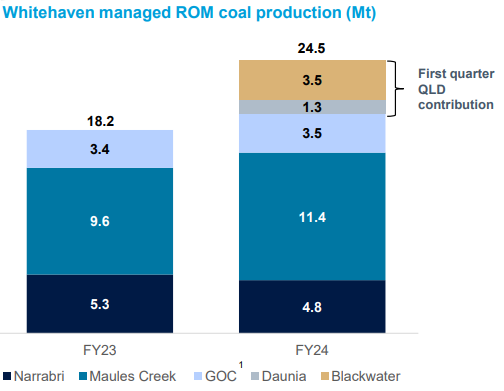

- Lower Profits: Whitehaven recorded a 72% fall in profits to $740 million, driven primarily by a 55% fall in the price of thermal coal to US$136 per tonne and transaction costs surrounding the acquisition of the Blackwater and Daunia mines. These lower coal prices were slightly offset by higher tons from WHC’s existing mines and the new met coal mines. (See Below)

- Buy Low and sell High! WHC announced the sale of 30% of its Blackwater mine to Nippon Steel and JFE Steel, Japan’s largest and second-largest steel makers, for US$1.08 billion. The sale is expected to be completed in the first quarter of CY25, which will provide WHC with nine months of full mine ownership profits and the transaction value of the sale. This was very popular with investors as it de-risks the met coal acquisition. Given WHC paid US$2.1 billion for 100% of the mines this is a pretty good trade and represents a 71% increase in their equity value since April. Going forward the Japanese steel mills will pay their share of bonus payments to BHP, a $2 per ton management fee to WHC and have signed offtake agreements to buy coal from these mines.

- Strong Balance Sheet: WHC currently has A$1.3 billion in net debt, representing a gearing ratio of 20%, but following the completion of the sale, Whitehaven would have a net cash position of A$300 million.

- Lower Dividend Not to Last: WHC announced a full-year fully franked dividend of 20 cents per share, representing a payout ratio of 22%. Following the 30% sale of Blackwater and better capital position, WHC management announced that they expect the board to reevaluate the capital framework policy of the payout ratio, which is between 20-50% of NPAT, Atlas expects a material increase in the dividend in the near future.

- Guidance: WHC management provided guidance that they expect to produce 37.3 million tonnes of coal next year with a group cost of A$148/t.

WHC finished up +6% to $7.65.

Portfolio Strategy: Whitehaven has undergone a transformational acquisition, that has seen the business move from a pure thermal coal miner to a combined metallurgical (steel) and thermal coal business. This acquisition from BHP grants Whitehaven access to new mining assets with 50+ years of mine life at a very low price of 1.9 times earnings and will see a significant increase in company profits regardless of any downward moves in the coal. Whitehaven thermal coal mines produce one of the highest quality coal exported mainly to Japan, with low ash content, meaning that Whitehaven coal collects a premium to international pricing and that these mines will be the last mines to close down. WHC trades on 5x earnings and a 6% dividend yield based on a 25% payout ratio.