Mineral Resources (MIN): This morning, the diversified miner and mining services company reported their full year 2024 results, which were below market expectations given the current lithium and iron ore prices. The HNW Portfolios hold a 2% weight to MIN.

Key Points:

- Profit Down: Profits for the year were down -50% to $114 million, driven primarily by a retreat in the lithium spodumene price, which was offset by higher profits from iron ore and mining services. This shows the benefits of MIN’s diversification with lithium rivals IGO and PLS reporting profits down –99% and -86% respectively.

- Across the Portfolio: Mining Services were the highlight of this result, producing record revenues and profits increasing by 32% and 14% respectively, and winning six new contracts across different commodities and construction (See Below). Production at the lithium mines have all increased by over 40% on last year driven by deferred stripping done over the year to access largest amount of higher quality lithium.

- Balance Sheet: MIN’s balance sheet currently is at the peak for net debt, though we are pretty relaxed as the increase in gearing is not due to a deterioration in MIN’s business but rather due to expansions in lithium and iron ore with the company spending $3.4 billion in 2024 to improve its operations. This has allowed Min to produce lithium spod at a much lower cost base than this time last year. During the half Min sold a 49% stake in their Onslow haulage road for $1.3 billion which will lower gearing in the coming months.

- Dividend Down: Min announced that they will not be providing a full-year dividend as they need to hold onto cash to pay down the debt while commodity price remain low. MIN full year dividend was 20 cents per share, down 89% on last year. This is a prudent move given the lithium market

- Guidance:. FY25 looks brighter for MIN with the company seeing a step change down in costs for iron ore, $1.3B coming in from the sale of a minority stake in a haulage road in the Pilbara along with continued growth in mining services. Small increased in the lithium price will dramatically change sentiment towards this stock.

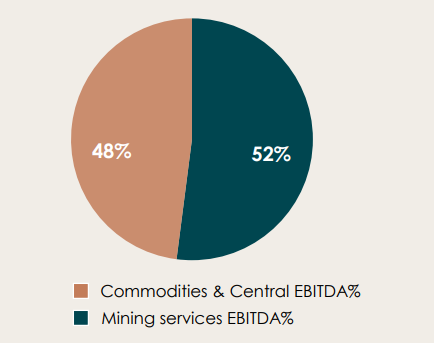

CEP Strategy: MIN is a diversified miner and mining services with four main business segments: mining services, lithium, iron ore and gas. Lithium is the jewel in MIN’s crown, with the company now the world’s 5th largest lithium miner with two operating Tier 1 hard rock mines in Western Australia as well as downstream processing. The company has a unique business model of owning assets and providing mining services to its own and external clients. This gives investors a per-tonne annuity income stream that is not correlated with commodity prices.

MIN finished down 8% to $40.61.