Wesfarmers (WES): presented their full-year 2024 results, which demonstrated that WES’ businesses are performing well in a consumer slowdown and taking market share. The HNW Portfolios have a 4% weight to WES.

Key Points:

- Record Profits: Earnings increased by 3.7%, to $2.6 billion, driven by 25% increases in Kmart group (Kmart & Target) earnings following strong growth on in their home brand Anko apparel brand. WesCEF (Chemical, Energy and Fertiliser) was negatively impacted throughout the year due to higher natural gas prices for their fertilisers and lower lithium hydroxide pricing. Wesfarmers remain confident in the long-term value creation and the lithium market’s tailwinds.

- The Strength of Bunnings: Wesfarmers’ flagship company, Bunnings, profits grew by 3% and continue to dominate after record years from the Covid pandemic’s work-from-home restrictions and renovations. Bunnings was able to grow its profits by being able to control its costs very closely, especially around labour costs, as they continue to face inflationary pressures. Bunnings is an excellent business with a 12% profit margin and an impressive 69% annual return on capital.

- Balance Sheet: WES continues to have a very strong balance sheet with a net debt position of $4 billion and $1.9 billion in unused bank facilities. This debt has increased due to investments in lithium that will contribute to earnings in the coming year.

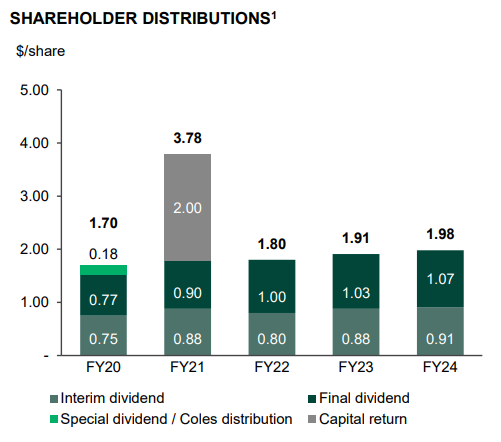

- Dividends Up: Wesfarmers announced a full-year fully franked dividend of $1.98, up 3.7%, (See Below) representing a payout ratio of 88%. WES also announced that they will be neutralising their Dividend Reinvestment Plan and purchasing the shares on-market, this will see a buy-back of around $200M.

- Guidance: Wesfarmers did not provide any explicit guidance, though WES did cite that Bunnings has had a strong start to the second half of 2024, with both Kmart and Officeworks performing in line with the second half of last year.

Portfolio Strategy: WES give the portfolio exposure to a stable, diversified stream of earnings exposed to the Australian economy primarily through hardware (Bunnings), office supplies (Officeworks), discount department stores (Target and Kmart), pharmacy (Priceline), chemicals and in the near future lithium. WES is a very well-run company, with CEO Rob Scott consistently making good moves for shareholders since taking over in 2018. In the portfolio, we only own the retailers that dominate their markets (Wesfarmers and JB Hi-FI) and are the lowest-cost operators. This result from WES shows that value-conscious consumers are still happy to open their wallets.

WES finished down -4% to $74.06 an overreaction to a very solid result from Australia’s best retailer though WES has been an exceptional performer in the Portfolio in 2024 up +31%.