This morning, Westpac Banking Corporation (WBC) provided a first-quarter update. We usually don’t comment on trading updates as they are too volatile and can give a misleading picture, both positive and negative, but today’s share price move warrants a brief note. The HNW Equity and Income Portfolios hold a 6% weight to WBC.

Key points:

- Mortgage Portfolio: increased by 4.2% to $490.9 billion but healthily and sustainably that will not see the bank have to worry about a mortgage rate cliff with only 19% of customers on a fixed rate loan.

- Net Interest Margin: fell slightly to 1.78%, as WBC continues to fight for deposits and

- Bad Debts: increased marginally by 0.03% to 0.1% of gross loans, well below the 0.3% pre-pandemic average and similar to CBA last week’s very low despite the “fixed interest rate cliff).

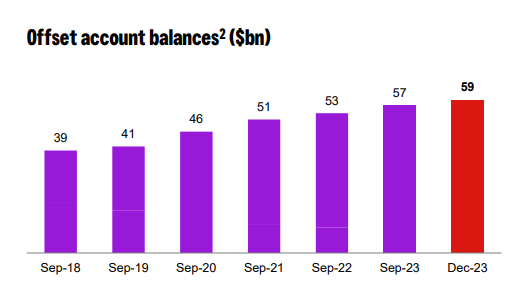

- Offset Account Balances continue to rise to $59 billion; although this detracts from the banks’ earnings, it creates a much stronger loan book for Westpac. (See below)

- Buyback: Westpac has been buying back stock since its full-year results in November, with the bank buying back $460 million worth of stock and $1.04 billion over the next four months, with the bank buying around $22M per day at the moment.

CEP Strategy: This was a solid result from Westpac, with the business travelling well. We own WBC in the Portfolio due to its heavy exposure to mortgages, which comprise 65% of WBC’s loan book. Through the cycle, mortgages have historically had lower bad debt charges than business lending due to Australia’s home loan recourse lending and higher margins. While we expect loan losses to increase, higher net interest margins will offset this. We remain happy holders of the bank, which trades on a PE of 12.5x with a 5.9% fully franked yield. Controlling costs was a highlight in the current inflationary environment.

WBC rose +3% to $25.24