Ampol (ALD), Australia’s largest energy distributor and retailer and the Portfolio’s largest overweight position, released a record full-year profit for 2023 this morning. This saw shareholders rewarded with franked distributions, with all divisions ahead of where they were pre-pandemic. The HNW Equity and Income Portfolios have a 5.5% weight to ALD.

Key Points:

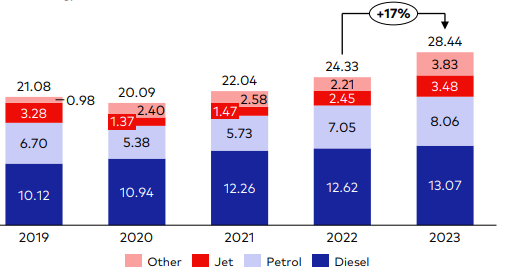

- Record Profits: Ampol delivered record earnings of $740 million, driven by a 17% increase in sales volumes, helped by a full year of Z Energy and the returning demand for jet fuel. Fuels and infrastructure, excluding Lytton, saw earnings grow by over 200%, driven by increased volumes and optimal freight and infrastructure management. Convenience Retail earnings saw continued momentum, driven by solid bakery, snacks and beverages growth. Z Energy in New Zealand has proven it was a good acquisition, with earnings growing by over 44% to $264 million, driven by wholesale sales volumes and leveraging its current infrastructure position.

- Lytton Refinery: Refinery margins pulled back to US$12.8/bbl from their unsustainably high margins of US$17.9/bbl last year. Although the margin has pulled back, it is now at a sustainable level, materially higher than during the pandemic. Also, ALD benefits from being one of the last two men standing in Australian refining, with government subsidies guaranteeing profitability stretching out to 2030.

- Balance Sheet: Ampol currently has a net debt position of $2.2 billion but the balance sheet remains very strong with leverage only at 1.6 times, below their target range of 2-2.5 times.

- Show me the money: Full year fully franked $2.15 dividend per share

- Special Dividend: Additional fully franked special dividend of 60 cents per share

- Outlook: Ampol did not provide explicit guidance for the coming year but did say they have had a strong start to this year with refining margins expanding to US$13.33/bbl as well as the convenience retail and Z Energy trading in line with this year.

Portfolio Strategy: ALD is the core energy exposure in the Portfolio but with greater exposure to fuel and food retailing rather than the vagaries of oil prices. Over the past five years, ALD has changed from a capital-intensive business with volatile earnings dependent on global refining margins to one increasingly based on fuel and convenience retailing and bringing franchised service stations in-house. ALD trades on an undemanding = 13x forward earnings with a 6% fully franked dividend yield. In 2023, ALD sold a record 28.4 billion litres of fuel, with significant gains in diesel and jet fuel.

Ampol finished up +1% to $37.88, a great result.