Lendlease (LLC), the multinational construction and asset management company, reported this morning with mixed results today, with this being their second year of changing the business to an investment-led company from a construction-led company. The HNW Equity Portfolio only has a 2% weight to LLC.

- Investments: Profits were down 36% to $91 million as Lendlease did not sell any assets this half compared to the last half, which saw the sale of Military Housing Assets. If the sale were excluded, investment earnings would have increased by 1%. Funds Management is unchanged at $48 billion, a good outcome given the weaker real estate market with inflows offsetting negative revaluations.

- Disciplined Development Pipeline: In November, Lendlease and Google mutually agreed not to pursue the development of four master-planned districts in San Jose. This has turned out to be a prudent decision; with the San Francisco commercial real estate market region now having a 37% vacancy rate, it would have been reckless for both companies to proceed with the development.

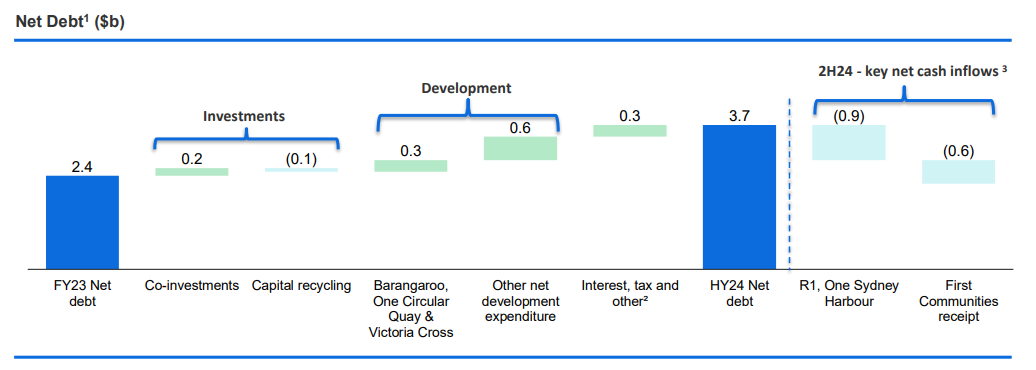

- Prioritising Balance Sheet Strength: Lendlease currently has a gearing ratio of 23%, but Lendlease expects to receive $1.5 billion from the sale of 12 of their communities and the settlement of One Sydney Harbour in the next six months, which will see gearing around 15%. (See below)

- Dividend: Due to Lendlease’s balance sheet strength, Lendlease increased the half-year dividend +33% to 6.5 cents per share despite their core operating profit after tax falling 42% to $61 million.

- Outlook: Lendlease provided group guidance of a return on equity of 7%, below their target range of 8-10%, as they cope with lower certainty of transaction timing and execution risks. Cashflows in the second half will be strong, with $1.5 billion coming from the completed Barangaroo Residential Tower and the first tranche of the $1.3 billion community payment from Stockland.

- Why is the stock off? Unlike other management teams LLC has very little credit in the bank. LLC had rallied 20% into the result in expecting more asset realisations in 1H FY 2024, which have been pushed out due to weak capital markets. While there is good visibility on these flows which are contracted to reliable parties, investors’ patience with management is thin.

Portfolio Strategy: LLC gives the portfolio exposure to a globally diverse pipeline of developments and gives good long-term earnings visibility. The volatility of company profits will decrease now the engineering business is off the books. The company’s business model is 1) to reduce risk by bringing in a financial partner at the development stage, 2) generate development profits as the projects such as office towers in Barangaroo are developed, then 3) vend the completed assets into an unlisted fund that they manage thus delivering ongoing annual funds management revenue. LLC remains a potential M&A target with a significant footprint in all the main developed markets, including UK/Europe, the US, Asia and Australia. Industry Fund Aware Super sits at 9% of the register. However, Atlas will review this position in light of other opportunities elsewhere on the ASX.

Lendlease finished down -14% to $6.46.