The Lotteries Corp (TLC), Australia’s largest lottery operator, released their full-year results this morning, demonstrating that the house always wins. The HNW Core Portfolio has a 3% weight & the Income has a 4% weight to TLC.

Key Points:

- Profits Up: TLC earnings were up +3.5% to $615 million. Revenue across the group was broadly in line, showing that consumers are happy to keep playing lotteries and keno despite rising cost of living pressures. Increased interest income due to higher interest rates from annuity lotteries (where the jackpot win is spread over 20 years) was offset by a lower number of large jackpots.

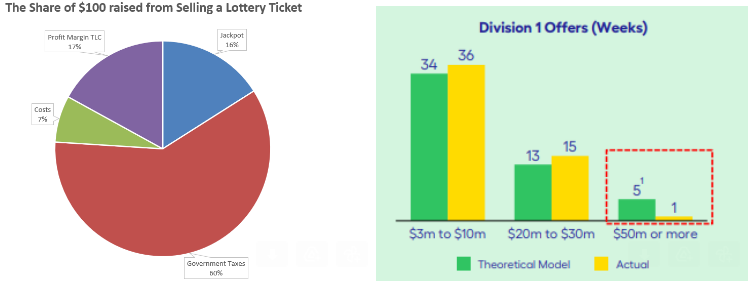

- Statistical Anomaly in 2023 to revert: This year was a once-in-20-year unfavourable jackpot year for Oz Lotto, as only one lottery over the past year has a jackpot over $50 million. Under TLC’s statistical probability model, on average, Oz Lotto should have five lotteries a year with a jackpot of over $50 million (see chart below), with this past year being at the lower end of the probability scale. Bigger jackpots benefit TLC as many players only choose to play the lottery when the jackpot is above a certain size, and TLC earns interest income on the increasing jackpot amount.

- First Final Dividend: TLC made its first final dividend payment of $0.06 today taking its full year fully franked dividend to $0.14 excluding a $0.01 special dividend paid in the first half.

- Balance Sheet: TLC’s balance sheet remains strong with a leverage ratio of 3.1 times, at the lower of their target range of 3-4 times with 86% of its debt on fixed interest rates.

- Guidance: No real explicit guidance was given, though TLC has proven through the cycle to be a very stable and cash-generative monopoly business. A normalisation of wins (i.e. a fewer number of small wins with the odds of winning a Division 1 Powerball 1 in 134 million) will boost profits in 2024.

Portfolio Strategy: TLC is Australia’s most stable gaming company and holds the monopoly licence to run lotteries in all Australian states except for WA. TLC’s lotteries business with long-duration licences (average expiry 2042) gives investors stable and defensive earnings, which would be very attractive as a potential takeover target. Increasing digital penetration of lotteries and keno played on smartphones increases TLC’s profit margin as the revenue leakage to newsagents, and clubs is reduced. Additionally, the high % of government taxes creates an incentive for the state to prevent competition.

The Portfolio’s move to favour the more “boring” and mechanical end of the gambling industry instead of casinos looks to be a good move, with Star Casinos down -61% and Endeavour (poker machines) down -21% over the past year due to increased regulatory risk and fines. The pie chart on the left shows the simplicity and transparency of TLC’s business model, which effectively guarantees a profit margin on each dollar invested in a lottery ticket, along with how heavily the government wets their beak in the lottery industry!

TLC finished unchanged at $5.15. TLC has been a solid citizen in the Portfolio, up +18% over the past year vs 7% for the ASX 200.