The Lotteries Corp (TLC), Australia’s largest lottery operator, released their half-year results for 2025 this morning, demonstrating that the house always wins. The HNW portfolios have a 3.3% weighting to TLC.

Key Points

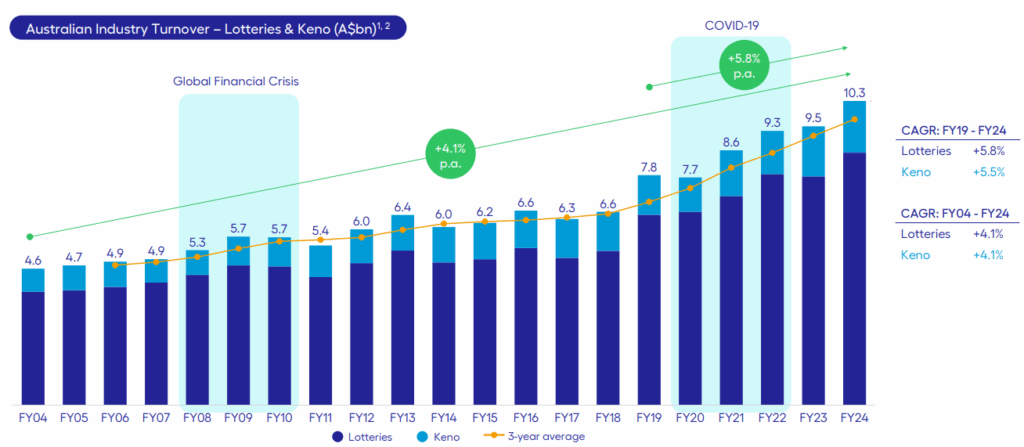

- Profits Down: TLC earnings decreased by 10% to $176 million, driven by poor timing for jackpots during the Black Friday weekend and the End-of-year jackpot being pushed into January. Revenue was down slightly by 6%, demonstrating that consumers are happy to keep playing lotteries and keno despite rising cost of living pressures. (See Below)

- Statistical Anomaly: During the half, three winners won the jackpot of $12 million, which, due to a low jackpot, does not attract the most players across the portfolio of games. Statistically, the jackpot should have been won less than once in the jackpot cycle due to the lower number of players.

- Robust Balance Sheet: TLC’s balance sheet remains robust, with a leverage ratio of 2.8 times below the target range of 3-4x earnings. This leaves TLC management with the flexibility to return excess capital to shareholders through a special dividend at year-end.

- Dividend: TLC announced a dividend of 8 cents per share, flat on last year, while jackpots were low during the half, a pleasing outcome.

- Why is the stock up?: The decline in earnings is temporary and primarily due to a timing issue with the Saturday Jackpot occurring on 1st January 2025, thus in 2H25. Additionally, 1H24 saw a greater frequency of large jackpots > $50M, with 1H25 seeing a normalisation of winnings.

- Outlook: TLC management did not provide specific guidance for the business but stated that they already had a $100 million jackpot during January that provided a strong base for the second half.

Portfolio Strategy: TLC, Australia’s most stable gaming company, holds the monopoly licence to run lotteries in all Australian states except WA. TLC’s lotteries business with long-duration licences (average expiry 2042) gives investors stable and defensive earnings, which would be very attractive as a potential takeover target. Increasing digital penetration of lotteries and keno played on smartphones increases TLC’s profit margin as the revenue leakage to newsagents and clubs is reduced. Additionally, the high % of government taxes creates an incentive for the state to prevent competition.

TLC finished up +3% to $5.07