Mineral Resources (MIN): This morning, the diversified miner and mining services company reported their half-year 2025 results, which were mixed with solid financial results offset by adverse weather. These results were in line with expectations, with MIN releasing production numbers in January, though the market took a different view. The Atlas Portfolio holds a 2% weight to MIN.

Key Points:

- Profits Down: Profits for the year were down to $-196 million, driven primarily by a retreat in the lithium spodumene price and temporary iron ore transport issues. MIN’s primary business, mining services, posted record profits of $376 million, driven by increased contract prices and higher volume. The lithium business is now cash flow positive with a recovery in prices.

- Adverse Weather: Management highlighted that the new haulage road to the port in Onslow was damaged during the five cyclones in January and February, which saw the worst rainfall in 40 years. This saw MIN unable to move iron ore for 17 days, but to combat this MIN is upgrading the road to asphalt, which will lower ongoing costs in the future. This cost MIN 1MT in the first half and 3MT in 2H until the road is repaired and sealed. This ore has been stored at the mine and, unlike milk, has no shelf life.

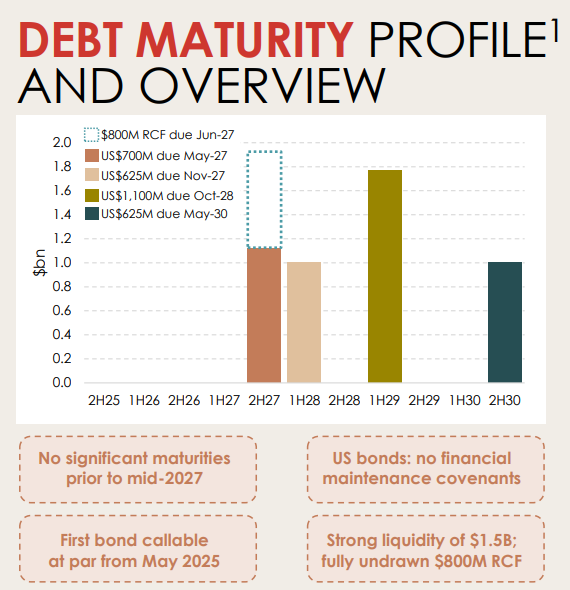

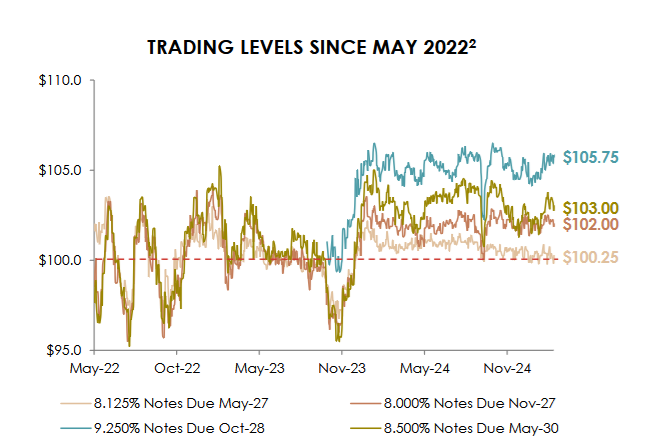

- Balance Sheet: MIN’s balance sheet currently is at the peak for net debt, though Atlas remains pretty relaxed as the increase in gearing is not due to a deterioration in MIN’s business but rather due to expansions in lithium and iron ore with the company spending $3.4 billion in 2024 to improve its operations. MIN debt has no covenants, with no debt due until 2027. (See Below) The sale of the energy business and the completion of the haulage road selldown during the half will provide great balance sheet flexibility.

- Dividend: While MIN continues ramping up its production at its Onslow iron ore mine, MIN did not pay a dividend for the half to conserve cash.

- Outlook: MIN management provided guidance for 20 million tonnes of iron ore shipped, with mining services contracted for 290 million tonnes mined for 2025. Management also highlighted that the lithium business will continue with cutting back on volumes across the next half to save on costs while deferred stripping continues in their mines.

- Why is the stock down? The stock is down due to increased spending on the haulage road due to the bad weather and a high level of debt. Whilst this will slow down the ramp of the Onslow mine, MIN ultimately has an iron ore business and mining services business that will produce $1 billion in earnings each with a lithium business that is slowly improving with lithium prices increasing off their lows. Today is a dark day for MIN, but the future looks brighter. In six months’ time, MIN will have an iron ore mine producing 35MT ($1B EBITDA at $75/t), a solid mining services business, and an improving lithium business.

CEP Strategy: MIN is a diversified miner and mining services company with four main business segments: mining services, lithium, iron ore, and gas. Lithium is the jewel in MIN’s crown, with the company now the world’s 5th largest lithium miner with two operating Tier 1 hard rock mines in Western Australia as well as downstream processing. The company has a unique business model that includes owning assets and providing mining services to its own and external clients. This gives investors a per-tonne annuity income stream that is not correlated with commodity prices.

MIN finished down 20% to $24.18 – an extreme reaction though on a rebound we have to reconsider MIN’s place in the HNW Income Portfolio