Deterra Royalties (DRR): Australia’s only iron ore royalty trust and the most boring miner on the ASX released their half year 2025. For DRR, there is minimal scope for surprises on results day as revenue and production data were pre-released, and the company is a royalty trust that passes through payments from BHP with a 95% profit margin. The HNW Portfolios currently hold a 2% weight in DRR.

Key Points:

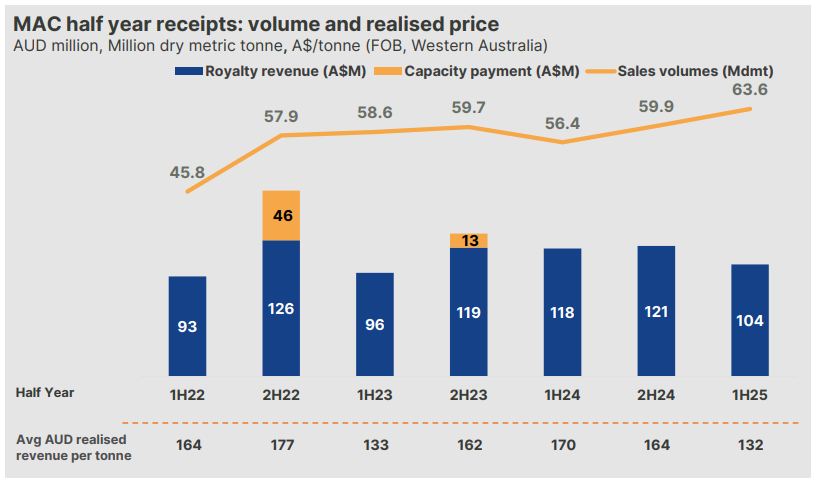

- Record Iron Ore Production: Deterra profits declined -19% following a 22% decline in the realised iron ore price over the year. Pleasingly, this was slightly offset by an increase in sales values by 13% to 64 million tonnes, which will likely see DRR receive a capacity payment in August. (See Below). Not a bad outcome in the context of BHP -26% fall in iron ore profits also reported today.

- Trident Acquisition looking better: The Trident acquisition has seen DRR move away from being a solely iron ore royalty company. During the half, DRR received $7.2 million in gold offtakes as both production and the price of gold increased. These offtakes will be used to service the debt until the large Thacker Pass lithium mine in Nevada is set the start production in 2027.

- Solid Balance Sheet: After taking on the Trident acquisition, DRR has $300 million in debt, which is well within what this business can handle. DRR management highlighted that they are looking to prioritise paying down the debt while they continue to for their next acquisition opportunity.

- Dividends: Deterra announced a half-year, fully-franked dividend of 9 cents per share, representing a 75% payout ratio of earnings, as management focused on paying down the acquisition debt.

- Outlook: Deterra management did not provide any explicit guidance, but they did reiterate that they are looking to continue the integration with Trident Royalties and are also evaluating other M&A opportunities in the market.

- Why is the stock down? DRR took the frugal to lower the dividend payout ratio to 75% from the traditional 100% when it was just an iron ore royalty. Whilst reducing the payout ratio is disappointing in the short-term, it creates much more long-term opportunities for M&A from reducing debt.

Portfolio Strategy: DRR is a royalty trust that owns an income stream based on 1.23% of the revenue BHP receives from iron ore mined in the Mining Area C iron ore tenements and gold offtakes from across the Americas and eventually lithium. Based on current production, the mine life of these assets currently stands at 30 years. As a royalty trust, DRR is not responsible for operating the mine, raising wages, any capital expenditure or clean-up costs, which is an attractive proposition in our opinion. DRR’s assets are low-cost and the diversification of royalty revenue streams will reduce volatility in the medium term.

DRR finished down -3% to $4.14