Charter Hall Retail (CQR): this morning, the supermarket landlord reported their half-year results for 2025, which were better than expected and head of rival RGN. Generally, there should be minimal excitement on results day for this very boring and stable supermarket trust. The HNW Income Fund has a 3.3% weight to CQR.

Key Points:

- Earnings Down: CQR reported operating earnings down 7% to $73 million, driven primarily by asset divestments, which was partially offset by a 3% increase in rental yields from shopping centres and 5% rental yield increases from service stations.

- HPI Acquisition: During the half, CQR and Charter Hall announced the acquisition of Hotel Property Investments (HPI), which sees the combined joint venture currently owning 85% of HPI. HPI has a $1.3 billion portfolio of 58 pub and accommodation assets across the Australian East Coast but focuses on Queensland.

- Balance Sheet: Following increased ownership of HPI, CQR gearing is now 32%, with an average cost of debt at 5%, with no debt maturing until 2026.

- Distribution Flat: CQR reported the first-half distribution of 12.3 cents per share, in line with last year’s distribution.

- Valuation: NTA increased by 6 cents to $4.57, following convenience retail valuation growth driven by inflation-linked rental income.

- Outlook: CQR reaffirmed guidance for FY25 operating earnings to be 25.4 cents per unit with a distribution of 24.7 cents per unit, representing a very healthy 7% distribution yield.

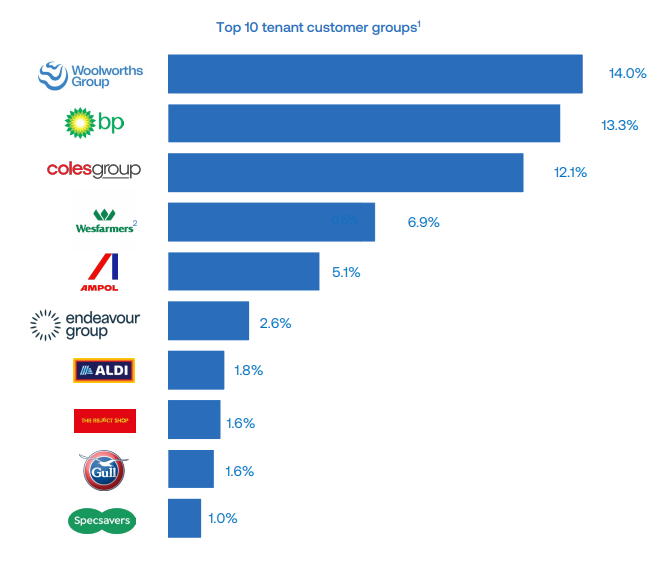

Portfolio Strategy: CQR offers the portfolio exposure to non-discretionary retailing via a diversified portfolio of neighbourhood shopping centres typically anchored by a Woolworths or Coles supermarket as well as service stations. Long leases linked to CPI to quality tenants such as Woolworths, Coles, Aldi and BP give a high degree of confidence that CQR can maintain and grow their distributions over time.

CQR finished up 3% to $3.38