Yesterday morning Transurban Group (TCL), the Australian and North American toll road operator, delivered record results with strong growth in revenues, traffic levels and profits. It is amazing that in 2020 some “experts” were calling toll roads stranded assets, with Australians locked up in their homes and groceries delivered by drones. The HNW Portfolios have a 5.5% weight to TCL, but we are looking to increase this weight following the next Investment Committee meeting.

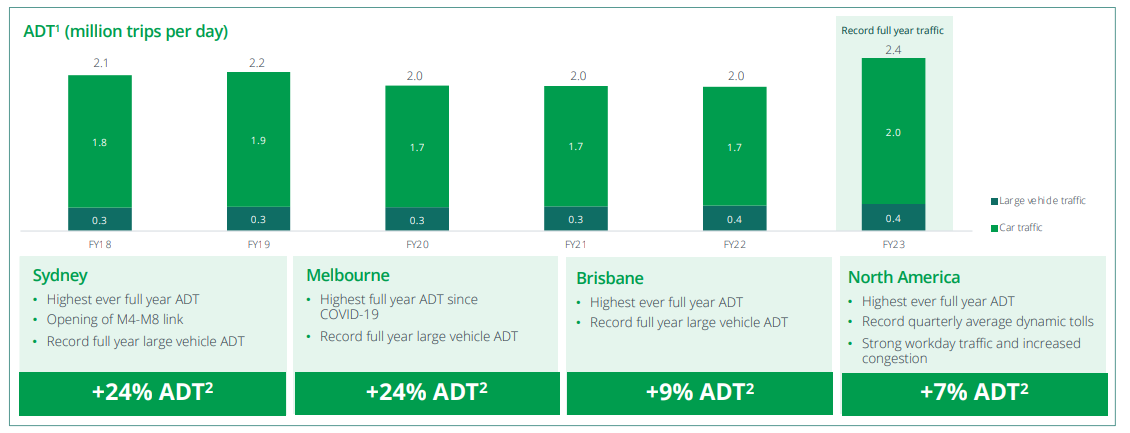

- Record Profits: TCL reported profit growth of 29% to $2.45 billion, driven by 1) record high traffic numbers across Australia and North America, 2) the contribution of new roads and 3) cycling periods in FY22 when economies were in lockdown. Sydney and Melbourne were the main contributors to the record high traffic, with both cities seeing average daily traffic increase by over 24%. As tolls are linked to inflation, TCL saw revenues and profit growth above traffic numbers.

- Record Distribution: Transurban delivered a record high full year distribution of $0.58, reflecting a 41% increase on last year.

- Long-Term Hedged Debt: Transurban has very long-dated debt, with the weighted average date to maturity being just under seven years, with 96% of the debt book having an interest rate hedge in place at an average cost of 4.1%.

- New CEO Appointed: Michelle Jablko has been appointed as Transurban’s new CEO and MD and will begin her duties in October this year. She has served as Transurban’s CFO since 2021 and is viewed by the market as a safe pair of hands and the logiocal choice.

- Guidance: Transurban provided guidance on their FY24 distributions of $0.62, representing +7% growth on FY23. 2024 will see the addition of the Rozelle Interchange and the Sydney Airport Gateway delivered, which will grow traffic on their roads along with the maturing of Westconnex. Management is also expecting a bump in traffic from the upcoming Taylor Swift tour in February, with Swifties using TCL’s roads to get to multiple concerts in Sydney and Melbourne.

Portfolio Strategy: Transurban is the world’s largest toll road concession operator. We are attracted to Transurban due to its high quality, long life, and monopolistic infrastructure assets. The company has demonstrated an ability to grow distributions ahead of inflation by both raising tolls and developing existing assets by adding extra lanes to accommodate the additional traffic. TCL’s revenues are generally linked to the greater of +4% or CPI and trades on an attractive dividend yield of 4.5%.

TCL finished down 0.7% to $13.86, a good result in a market that finished down 1.5%.