Deterra Royalties (DRR): Australia’s only iron ore royalty trust and the most boring miner on the ASX released their full year 2023. For DRR, there is minimal scope for surprises on results day as revenue and production data were pre-released, and the company is a royalty trust that passes through payments from BHP with a 96% profit margin. The Core and Income Portfolios currently holds a 3.5% weight in DRR.

- Record Mining Volumes: Mining Area C (MAC) sales increased 14% up to 118.3 million dry metric tonnes, with revenue falling 2% due to a 15% reduction in realised iron ore prices to $148 per dry metric tonne and a 72% reduction in one-off capacity increase payments as per expectations.

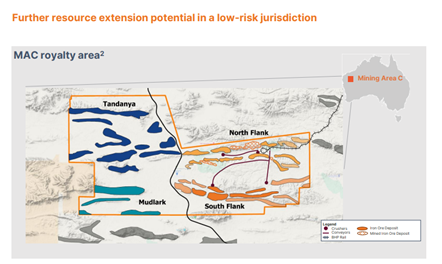

- Expansion Remaining on Track: MAC South Flank expansion remains on schedule to reach 80 million wet tonnes per year by the end of FY24. This would take MAC total output to 145 million wet tonnes per annum. DRR will continue benefiting from BHP peddling hard to increase production out of DRR’s royalty area to offset production declines from BHP’s declining Yandi system.

- No Debt: Due to Deterra being simply a royalty trust, it has no borrowings on its balance sheet, meaning no repayments with a net cash position of $30 million.

- Dividends: Deterra continued distribute all of its $153 million in earnings to shareholders, reflecting a full year fully frank $0.2885 dividend = 6.3% fully franked yield.

- Outlook: Deterra is looking to potentially diversify away from just the Mining Area C royalty into other royalty streams but remains cautious as access to traditional funding sources has become more challenging in this higher interest rate environment.

Portfolio Strategy: DRR is a royalty trust that owns an income stream based on 1.23% of the revenue BHP receives from iron ore mined in the Mining Area C iron ore tenements. Based on current production, the mine life of these assets currently stands at 30 years. As a royalty trust, DRR is not responsible for operating the mine, rising wages, any capital expenditure or clean-up costs, which is an attractive proposition in our opinion.

DRR was up 2.4% to $4.57.