Suncorp (SUN): this morning, the Queensland-based insurer and bank operator delivered a mixed first-half result for 2024—strong performance from general insurance, weak in the bank, which is no longer an issue. The HNW Portfolios have a 2.5% weight to SUN.

Key Points:

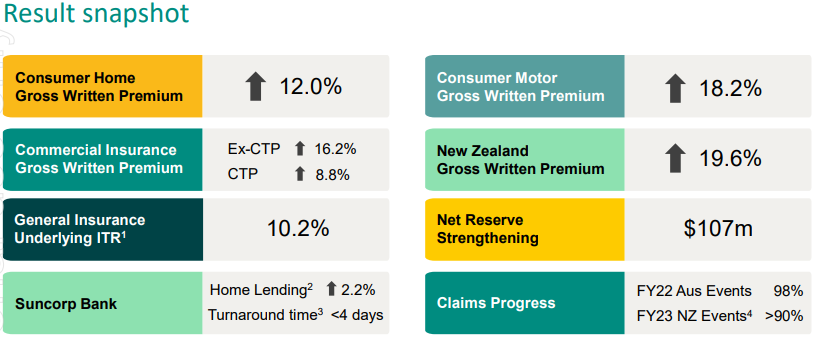

- Record Profits: Suncorp has been able to continue its strength from last year into 2024, posting profit growth of 13.8% to $660 million, driven by strong results in Australian general insurance that saw home insurance premiums increase by 12% and motor insurance premiums increase by 18% (see below). New Zealand insurance profits fell after two large weather events that saw natural hazard claims and reinsurance costs rise during the half. New Zealand also saw higher costs in the half following supply restrictions, especially around sourcing car parts and labour.

- Suncorp Bank: Profits were down -25%, following their net interest margin compression from 1.89% to 1.8%. The bank saw many depositors move from transaction accounts into much high yielding savings and term accounts. As announced last week, the bank will be sold to ANZ for $5 billion so there isn’t much weight currently attached to the bank’s performance.

- Increased Investment Income: Across Suncorp’s $16.5 billion investment float, they were able to return 5.5% or $409 million, up from $146 million in 2023. The best in a decade for SUN.

- Increased dividends: Suncorp announced a fully franked half-year dividend of $0.34, up 3%, representing a payout ratio of 65%.

Future capital Management in August: SUN expects to receive the $5B cheque from ANZ for their bank in June, which they have committed to return to shareholders – this equates to around $3.20 per share. Atlas expects this to be a combination of tax-free return of capital and market share-buyback to neutralise the impact of lost banking earnings.

- Outlook: Management has guided for an average premium growth of single to mid-teens, with an expected slowdown in claims inflation throughout the half. The business is generally firing on all cylinders; premium rates are rising, insurance underwriting has been prudent, and investment income has been the best in the last 15 years.

CEP Strategy: SUN is a diversified insurance and banking group but will soon be a pure domestic insurer. We are attracted to SUN as it exposes the portfolio to rising insurance premiums across Eastern Australia and higher interest rates. We have preferred SUN over IAG as our domestic insurance exposure as it is much cheaper, better managed (no Greensill mess), and management has historically rewarded shareholders with capital returns rather than hoarding cash on the balance sheet. This result confirms Atlas’ investment thesis.

SUN trades on 14x forward earnings with a 4.5% yield. As expected, we continue to see SUN re-rate higher as a pure-play general insurer. Upcoming capital management will be positive.

SUN finished up +3.5% to $15.66.