This morning, Bapcor (BAP), Australia’s largest vehicle parts, accessories and equipment provider, reported results that had no new surprises as they provided a trading update in late January. The HNW Equity Portfolio has a 2.5% weight to Bapcor.

Key Points:

- Profits Down: Revenue up +2% but net profit was down -13% to $54 million, driven by weaker retail spending on high-margin discretionary items and higher interest costs . Trade and Wholesale businesses both saw good profit growth throughout the half, growing at 4% and 5% respectively. It was pleasing to see the New Zealand business return to 7% profit growth following last year’s cyclones and floods.

- Better Than Before: A cost-cutting initiative introduced by the last CEO has begun progressing well within the business, saving $7 million in EBIT through commercial, procurement and cost levers. This initiative has been guided to add a further 7-10 million in profit over the next half.

- Dividend: Bapcor announced a dividend of 9.5 cents per share, representing a payout ratio of 59.5%, at the upper end of their dividend policy.

- Balance Sheet: The balance sheet remains robust, with net debt remaining stable at $332 million and a leverage ratio of 1.51 times.

- Guidance: Management did not provide explicit guidance but provided a trading update outlining the first six weeks of 2024 which has started well. Revenues are up +4% on the same period in 2023.

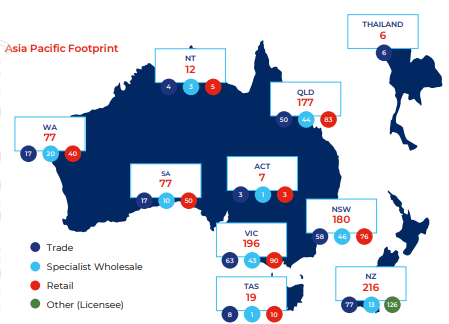

Portfolio Strategy: Bapcor provides the Portfolio exposure to automotive parts aftermarkets across Australia and New Zealand through motor vehicles (Burson), Trucks (Truckline), Agriculture (Bearing Wholesalers) and servicing (Midas). Bapcor benefits from the constantly aging car fleets of Australia and New Zealand that require more frequent servicing, with the average vehicle age increasing from 9.5 years before the pandemic to over 11 years now. Over the medium term, Bapcor will benefit from the transition to EVs, with many components of EVs needing more regular servicing. This result showed the resilience of the trade and wholesale car and truck part markets which as we expected are largely non-discretionary. Bapcor trades on 14x forward earnings with a dividend yield of 4%.

BAP finished flat on the day to $5.99