This morning, Woodside (WDS) reported their full-year 2023 results, which came in with few surprises with the company providing production guidance in January and mercifully walking away from merger discussions with Santos, which would have seen Woodside shareholders funding Santos’ inferior growth projects. The HNW Equity portfolio has a 5% & the Income a 7% allocation to WDS.

Key points

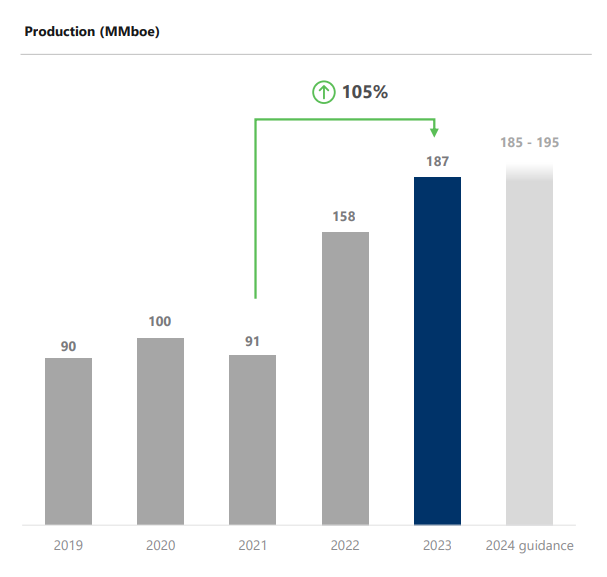

- Profits Down: Net profits of US$3.3 billion, down 37%, driven primarily by a decrease in the realised oil price, down to $68.6 a barrel from US$98.4 a barrel last year. This was partially offset by record volume production numbers due to WDS almost having 100% uptime, with WDS producing 187.2 million barrels of oil, up from 158 million barrels of oil last year (see below). Unit production costs remained steady at $8.3 per barrel.

- Scarborough Sell-down: During the half, Woodside sold 10% of Scarborough to LNG Japan and last week sold a 15% interest to JERA (Japan’s largest power generation company) raising US$2.4 billion along with long term offtake agreements commencing in 2026. This sell-down takes the pressure off WDS’s balance sheet, de-risks the project and demonstrates there is still substantial demand for their assets.

- Dividends Down: The full-year fully franked dividend was US$1.40, representing an 80% payout ratio. For Australian shareholders, the dividend will be A$2.14 due to a weaker AUD.

- Strong Balance Sheet: Woodside maintains an extremely strong balance sheet, with 12% gearing at the lower end of their target range of 10-20% gearing. This is very impressive when the company has heavily reinvested within itself for expansions whilst distributing high amounts of dividends.

- Guidance: Woodside didn’t provide concrete guidance but stated that they expect to get their first oil from Sangomar this year and were confident they could be their record production number this year, guiding to 185-195 million barrels. 2024 has started of strongly with oil averaging US$80/bl ahead of 2023.

Portfolio Strategy: WDS is the Portfolio’s sole energy exposure and is the most conservative and well-managed Australian oil company. WDS has the lowest production cost and gearing, an essential position for an energy company as conditions are not always as sunny as they currently are. WDS has minimal exposure to the East Coast gas market, where politicians are floating legislation requiring these LNG producers to break long-term 20-year export contracts with Asian utilities to reserve gas for the domestic market, which faces supply constraints due to moratoriums on new gas projects in NSW and Victoria. The company trades on an undemanding PE of 12x with a 6% yield based on US$70/bl oil.

Woodside finished up +1% to $30.28