Sonic Healthcare (SHL). This morning, global pathology company SHL reported its full-year profit results, which were solid but a little below expectations. The HNW Portfolio has a 3.5% weight to Sonic.

Key Points:

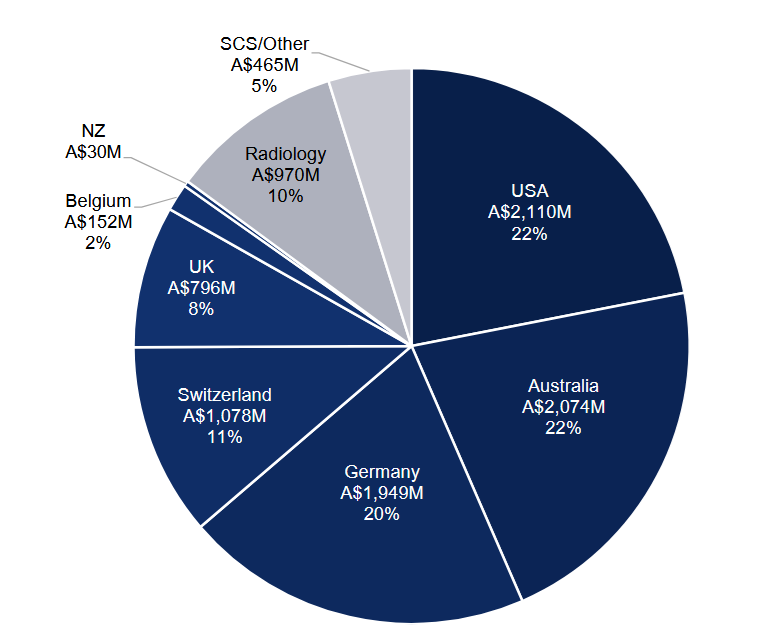

- Profits: Profits increased by +7% to $514 million but missed by $20 million due to slightly lower US revenue growth, resulting from a contract loss in Alabama, a small increase in labour costs, and higher taxes. The highlights were Switzerland, Germany and UK, with Australia steady. Profit margin expanded, which was a positive.

- Cashflow Strong: operating cash generated up +21% to $1,297 million

- Dividend: A modest increase of +1% to $1.07 per share in line with SHL’s progressive dividend policy supported by strong cash generation.

- Continued Balance Sheet Strength: Gearing at 24% with an interest cover ratio (annual profit divided by interest cost) of 10 times, there are no anxious bankers.

- Why is the stock off? The 2025 net profit missed the consensus by a small amount, and some in the market had higher profit growth expectations for 2026. Very much a theme for the August 2025 reporting season.

- Outlook: Sonic management provided guidance for profit growth of +13% for 2026, based on organic growth, two large acquisition in Germany and New York that was finalised in July, and a contract win in New Jersey.

Portfolio Strategy: Sonic and CSL represent the core healthcare positions in the Portfolio. SHL exposes us to the rising demand for medical testing, exacerbated by new medical technologies, an aging population, and doctors’ desire to cover themselves against malpractice claims by increasing the number of tests ordered. SHL is one of the largest global patient testing companies, ranking #1 in pathology in Australia, Germany, and Switzerland, #2 in the UK, and #3 in the USA. Unlike drug companies or device companies, such as Cochlear, SHL has an industrial process for blood and tissue sample testing that benefits from economies of scale, rather than the hundreds of millions of dollars invested in R&D to develop the next wonder drug or device.

There was nothing in this result that changed our investment case for Sonic Health. In the medium term, SHL will benefit from an older and sicker population, and doctors will schedule more tests to avoid malpractice suits, particularly in the USA, where SHL is now the third largest pathology company. Pathology as a business

SHL finished down 12.8% to $25.05, an overreaction to a small $20 million miss from a company with annual revenues of $10 billion.