Medibank Private (MPL): This morning, Australia’s largest health insurer reported its full-year 2025 results, which showed that MPL’s disciplined approach to volume growth has won over the long term. The HNW Portfolio holds a 3% in MPL.

Key Points:

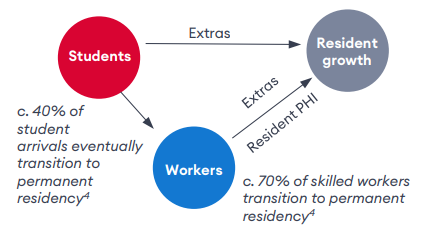

- Record Profits: Medibank recorded a net profit increase of 9% to $619 million, driven by a 4% increase in premiums, with a notable highlight being a 13% increase in non-resident (foreign students) policyholders, as students continue to return following Covid-19 lockdowns. International students continue to be a key market for MPL, with 40% of them becoming permanent residents after completing their studies, and 70% of skilled workers also obtaining permanent residency. (See Below). This is a profitable market for MPL, with this relatively healthy cohort being forced to have private health insurance.

- Medibank Health: Increased profits by 27% following increased uptake in home care and telehealth revenue, driven by patients undertaking more day surgeries so they can go home as soon as possible and still get the required consultations.

- Investment Returns: MPL’s investment portfolio returned $208 million over the year, representing a 14% increase from the previous year.

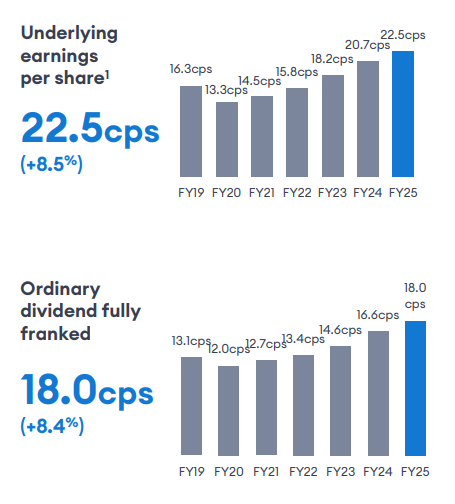

- Record Dividend: MPL announced a fully franked dividend of 18 cents per share, representing 8.4% growth from last year. The payout ratio represented an 80% payout of profits at the mid-point of the target range of 75-85%.

- Guidance: MPL management did not provide explicit guidance but stated that they expect moderate increases in both policyholders and gross profit, driven by productivity savings across the business.

- Why is the stock down? The stock is down due to MPL’s expectation that fewer people will be taking out private health insurance next year. As the lowest-cost operator and industry incumbent, growth isn’t as much of a priority as maintaining sustainable, profitable growth. Atlas would not be keen on seeing MPL adopt NIB’s strategy of chasing unprofitable growth.

Portfolio Strategy: We own MPL in the Portfolio because its healthcare earnings are defensive, and it is a well-run business. Despite its high market share, MPL’s gross margins and management expense ratios are higher than those of its competitors in the industry, reflecting its recent past as a government department. However, management has been slowly taking costs and improving margins. Over the medium term, MPLs will move to improve their digital health experience and have patients treated at home rather than in private hospitals, driving profit growth, expanding margins, and achieving a good outcome for recovering patients.

MPL finished down -2% to $5.02, but has been a solid performer in the Portfolio, returning 33% over the past year.