QBE Insurance (QBE): The global insurer released its first-half 2024 profit results, confirming the continuation of positive trends in the insurance industry, including increasing premiums and lower claims inflation. Overall, a very solid result from QBE and their best result since John Howard was PM, reflecting years of cleaning up the business The HNW Portfolios have an 4.5% weight to QBE.

Key Points:

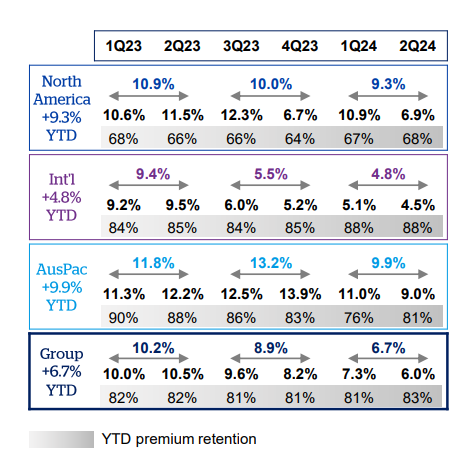

- Profits Up: QBE’s net profit was up +92% to US$777 million, driven by a +7% increase in premium rates and an +11% in premium volumes. The business is firing on all cylinders, enjoying hardening rates, good underwriting and higher interest rates. Europe was the highlight, though globally catastrophe claims were very benign, inclusive of the Baltimore Bridge collapse and riots in New Caledonia.

- Investment Float: The net return on QBE’s $30.5 billion investment float was US$733 million, representing a return of 4.8%. The move from near-zero interest rates a few years ago has seen a big increase in returns from the investment portfolio.

- Strong Balance Sheet: The balance sheet remains in good shape, with their regulatory capital at the top end of the range at 1.76x (1.6-1.8x) and gearing well within their target range at 27%.

- Dividend Up: Up +71% to $A0.24 per share (20% franked), representing a very miserly 31% payout ratio. This is normal for QBE, which typically has a larger second-half dividend, waiting until after the conclusion of the US hurricane season (October) before rewarding shareholders.

- Outlook: Management expects to see a 3% growth in premium volumes throughout 2024, with an insurance operating margin of 6.5% and an exit investment yield of 4.7% on their $30.5 billion investment portfolio or $1.4 billion profit.

- Why is the stock down? QBE is currently exiting non-core US mid-market insurance, which has been unprofitable for many years. Over the coming three years, this unprofitability will come with an impairment of $300 million. Although this is not ideal, Atlas see this as addition by subtraction and appreciates the move by management to sacrifice revenue for profits.

QBE finished down -1.7% to $16.05; despite this fall, QBE has been a solid citizen in the portfolio in 2024, up +12% vs the ASX200 +3%

Portfolio Strategy: QBE has a diverse class of insurance business lines across Australia, Asia, Europe, and America, and it exposes the portfolio to both falling AUD, rising interest rates, and a hardening of insurance pricing globally. This result shows the benefits of the simplification drive over the past five years. QBE has jettison exotic businesses such as Argentinian workers comp, Columbian third-party motor, and Ecuadorian crop insurance acquired during QBE’s growth at all costs phase 15 years ago. QBE is managing inflation well by pushing through premium increases (see chart below) and is benefiting from rising rates. QBE trades on a forward PE of 9x with a 5% yield based on a 60% payout ratio.