This morning the August 2024 reporting season kicked off with for us. Transurban (TCL), the Australian and North American toll road operator, delivered a record full-year results with strong revenue growth, traffic levels and profits. It is amazing that in 2020, some “experts” were calling toll roads stranded assets, with Australians still be locked up in their homes and groceries delivered by drones. The HNW Equity Portfolio has a 5.8% and the Income a 5% weight to TCL.

Key Points:

- Record Profit Transurban reported profit growth of +8% to $2.6 billion for the full year, driven by a 7% increase in toll revenue and only a 3.6% increase in costs, which was below the rate of inflation though toll road are a very high profit margin business – 73% in TCL’s case. The toll revenue increase was driven by a 2% increase in average daily traffic alongside inflation-linked toll escalations.

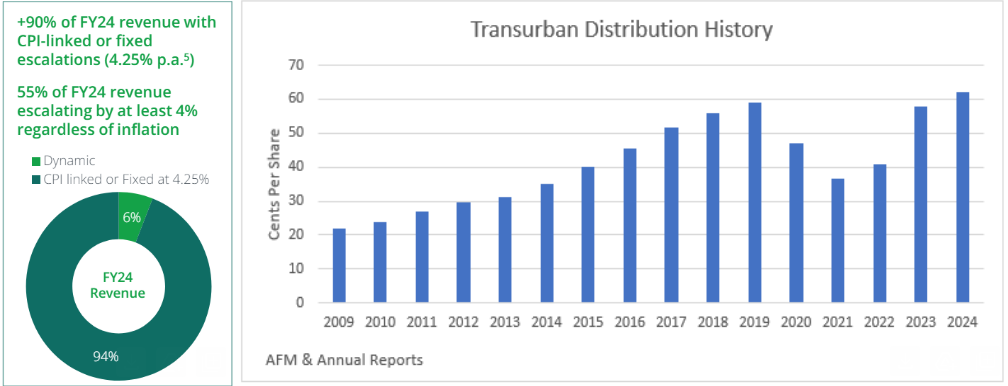

- Record Distribution: Transurban delivered a record full-year distribution of $0.62, reflecting a 7% increase from last year. From the below table on the right TCL have an excellent long-term record of growing dividends per share.

- NSW Toll Review: Transurban is currently in talks with the NSW government about a toll reform on NSW toll roads. Transurban and its partners have invested $36 billion in NSW toll roads under strict concession contracts that the NSW government has recognised that they will need to honour. Atlas’ view is that given the varying ownership structure of toll roads in NSW and water-tight contracts, any changes to the CPI linked increases in tolls are likely to be small and offset by increases in concession length.

- Strong Balance Sheet: Transurban continues to have a strong balance sheet with very long-dated debt, with an average debt-to-maturity of 6.7 years. 88% of the debt book is interest-rate hedged at an average cost of 4.5%.

- Guidance: TCL has guided to a full-year distribution of $0.65 per share next year, representing a +5% increase of the FY24 distribution.

Portfolio Strategy: Transurban is the world’s largest toll road concession operator. We are attracted to Transurban due to its high quality, long life, and monopolistic infrastructure assets. The company has demonstrated an ability to grow distributions ahead of inflation by both raising tolls and developing existing assets by adding extra lanes to accommodate the additional traffic such as the upcoming expansion of the Logan Motorway in Brisbane. TCL’s revenues are generally linked to the greater of +4% or CPI and trades on an attractive dividend yield of 5.1%.

TCL finished down -0.8% to $12.78.