This morning, JB HI-FI (JBH), the local electronics and home appliance retailer provider, delivered a strong full-year result that was ahead of market expectations despite what was thought to be a tougher economic environment for retailers. The HNW Equity and Income Portfolios both have a 2% weight to JBH. This position was reduced by 0.75% in late July (~$69) in what appears to be a bit premature today.

Key Points:

- Profits Better than expected: In FY24, JBH maintained sales at $9.6 billion, in line with last year’s record level of sales, which was a surprise as we expected 5-10% falls in revenue as cash-strapped consumers tightened their belts. Revenue was underpinned by JB Hi-Fi Australia, which saw revenue growth of +1% to $6.6 billion driven by Mobile Phones, Small Appliances, Cameras and Game Hardware. Good Guys’ revenue fell 5% to $2.7 billion, but its dominant core home appliance categories remained resilient throughout the year. Net profits of $439 million were ahead of expectations.

- Gaining Market Share: On the call with management, it appeared that JBH was dropping prices to gain market share at the expense of higher-cost rival Harvey Norman, though this won’t be revealed until 30/8 when HVN reports.

- Superior Cost-Saving Strategy: JB Hi-Fi has been able to keep its margins from slipping materially by pulling many different levers regarding costs, especially when it comes to labour cost flexibility. JB Hi-Fi Australia saw costs rise by 5.5%, while The Good Guys saw costs rise by 3.9% over the year, which is very impressive considering the 5.75% increase to the minimum award wage in the first half of FY2024.

- No Debt: JBH continues to have one of the best balance sheets on the ASX, with a net positive cash position of $303 million. This is very different to key competitor HVN, which has $1.7 billion in debt with annual interest costs of ~ $110 million.

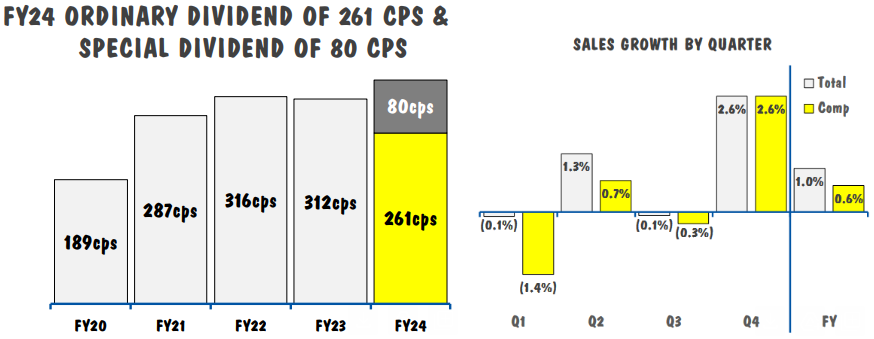

- Special Dividend: In addition to the full-year dividend of $2.61 per share, which was fully franked, JBH also announced a special dividend of 80 cents per share, which was fully franked following the business’s strong capital position. (See Below) These dividends represent a +9% increase on last year’s dividend.

- Why is the stock up?: Surprise 80-cent special dividend and strong 4th quarter in sales momentum that has carried over into July.

- Outlook: JBH provided a strong trading update showing that JB Hi-Fi Australia grew sales by over +5% in July, with the Good Guys also growing sales by over 2% for the month of July.

Portfolio Strategy: JBH’s business model is based on low prices, low overheads, and high volumes. Regarding the cost of doing business (rent, administration and sales staff costs), divided by sales – JBH is one of the most efficient retailers globally. This is a remarkable outcome given Australia’s high wages and is Australia’s largest electrical retailer and the world’s seventh-largest electrical retailer. More importantly, JBH has consistently recognised declining (CDs) and growing (fitness devices) categories and switched inventory to take advantage of these shifts; the expansion into Home and white goods has proved very successful.

JBH is currently trading on a PE of 17x with a 4.5% fully franked yield. This result indicates that JBH is leveraging its lower-cost position to increase its market share.

JB HI-FI finished up +8.3% to $72.98, following a strong result.