Mineral Resources (MIN): This morning, the diversified miner and mining services company reported their full year 2023 results, which were very strong and ahead of expectations, though it took the market some time to digest the numbers—possibly the best result of the August 2023 season. The HNW Income Portfolio holds a 4% weight to MIN & the Core Equity 2.75%, but on days like today, one wishes it was 40%.

Key Points:

- Record Profits: Record net profit of A$769 million, up +92%, significantly higher than consensus, with the company benefitting from higher volumes in lithium, higher realised prices for both iron ore and lithium and a lower Australian dollar. Free cash flow was very strong at $1.1 billion.

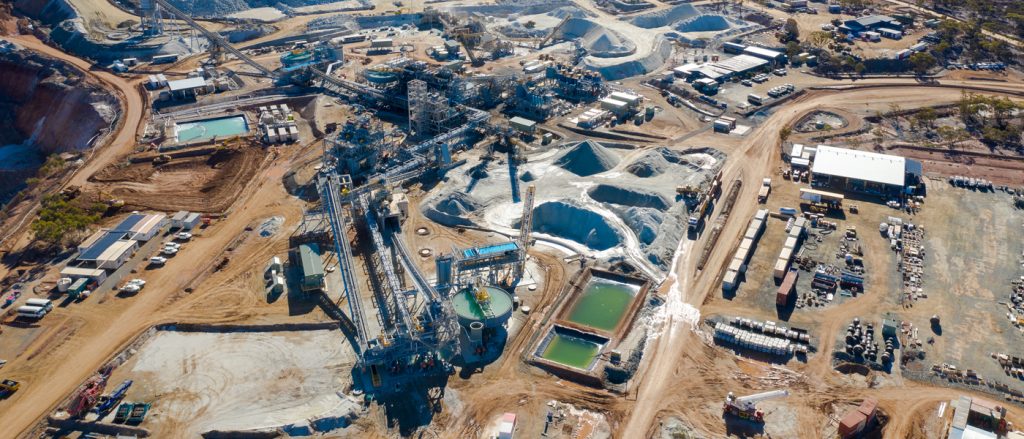

- Around the Grounds: Mining services were steady, with the big move in lithium due to higher prices and improved margins from converting rock into battery chemicals. MIN has had an unusually busy half, exiting a Chinese downstream joint venture in exchange for cash and a bigger share of the Wogina mine and successfully expanding the Mt Marion lithium plant, which will double production to 900K tonnes of 6% Spodumene per annum.

- Record Dividends: Full-year dividend of $1.90 fully franked up +90% from FY22, which was pleasing for shareholders.

- Balance Sheet: MIN’s balance sheet was the only area of concern on the analyst call, though we are pretty relaxed as the increase in gearing is not due to a deterioration in MIN’s business but rather due to expansions in lithium and iron ore with the company spending $1.7 billion in 2023 to improve its operations. These growth projects will lower production costs and increase volumes, leading to a de-gearing of MIN’s balance sheet. MIN has no debt due until 2027 and has a 7 times interest cover, so the banking wolves are now howling at their door. Exiting the Chinese JV reduces stress on MIN’s balance sheet.

- Guidance: Management guided to ¬ 400 kt spodumene production at an average production cost A$1K per tonne (spot price US$3K) = a 33% lift in production for FY24. We were very pleased with MIN’s cost control, which is far superior to their competitors and probably reflects MIN’s unusual background as an efficient mining services company. Continued AUD weakness since June will provide a tailwind with MIN’s costs in AUD and revenues in USD.

CEP Strategy: MIN is a diversified miner and mining services with four main business segments: mining services, lithium, iron ore and gas. Lithium is the jewel in MIN’s crown, with the company now the world’s 5th largest lithium miner with two operating Tier 1 hard rock mines in Western Australia as well as downstream processing. The company has a unique business model of owning assets and providing mining services to its own and external clients. This gives investors a per-tonne annuity income stream that is not correlated with commodity prices. MIN trades on an undemanding forward PE of 10x with a 5% fully franked yield.

MIN finished up +8% to $69.48.