This morning, Dexus Industrial (DXI), the industrial REIT reported their full-year results for 2024, which demonstrated the continued demand for industrial real estate assets. The HNW Income Portfolio holds a 3.5% weight to DXI.

Key Points:

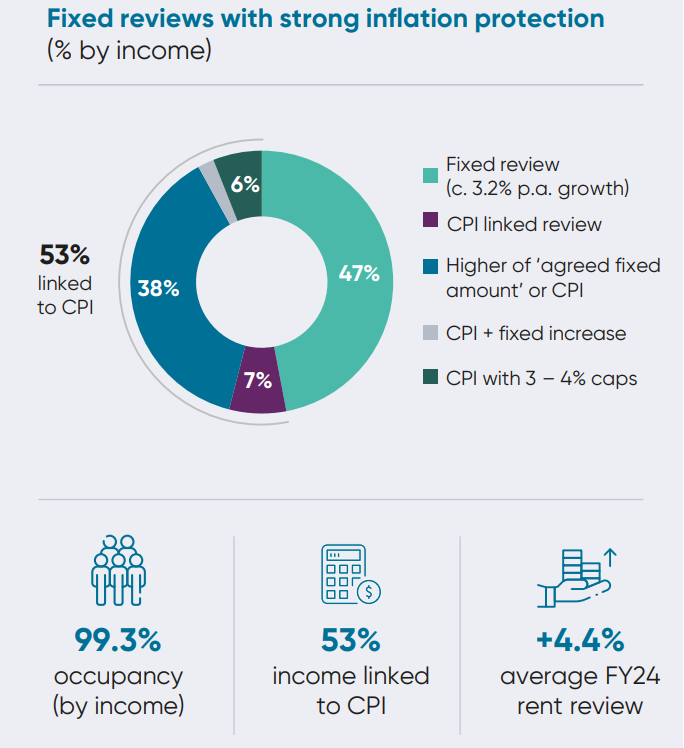

- Profits Up: Funds From Operations (FFO) were up 2% to $55.3 million or 17.4 cents per security, benefitting from lower average debt over the half leading to lower interest repayments. Operationally DXI is continuing to perform strongly with occupancy at 99% across their portfolio, and a six-year weighted average lease term saw 7.8% rental income growth. More importantly, DXI increased their occupancy for problem child Brisbane Technology Park to 98% from 86% in June 2023.

- Distributions: Distributions were in line with last year at 16.4 cents per security, a good outcome given the asset sales to reduce debt and development spend at Perth Airport and Moorebank.

- Valuation: NTA $3.24 per share, a slight decrease due to asset sales. Atlas sees that the 6% cap rate looks conservative, with similar industrial assets in Sydney and Melbourne trading around 4-4.4%.

- Continued Balance Sheet Strength: Despite a slight decrease in the valuations, continued asset sales saw gearing decline to 20% (below the target range of 30-40%) with an average maturity of debt of 3.5 years. Unlike other LPTs, DXI were quicker to recognise changing conditions and began selling assets in 2022 to reduce debt and improve the average quality of their portfolio, selling a further $114 million of assets over the past six months.

- Guidance: DXI management announced guidance for FY2025 with FFO of 17.8 cents per security and 16.4 distribution per security, driven by high demand and low vacancy rates.

Portfolio Strategy: DXI is a well-managed industrial REIT owning a diversified portfolio of industrial real estate valued at $1.6b with a development pipeline that will deliver earnings and distribution growth in the future. DXI trades at a 12% discount to NTA and on a 6% yield paid quarterly.

DXI finished down -2% to $2.83