Arena REIT (ARF): The listed childcare and medical centre owner reported their full-year 2024 results, which, as always, were consistent and steady. One of the key reasons we like ARF is the predictability of company earnings. With 100% occupancy, government support and a lease term of 19 years, there is not much scope for nasty surprises. The HNW Income Portfolio has a 4% weight to ARF

Key Points:

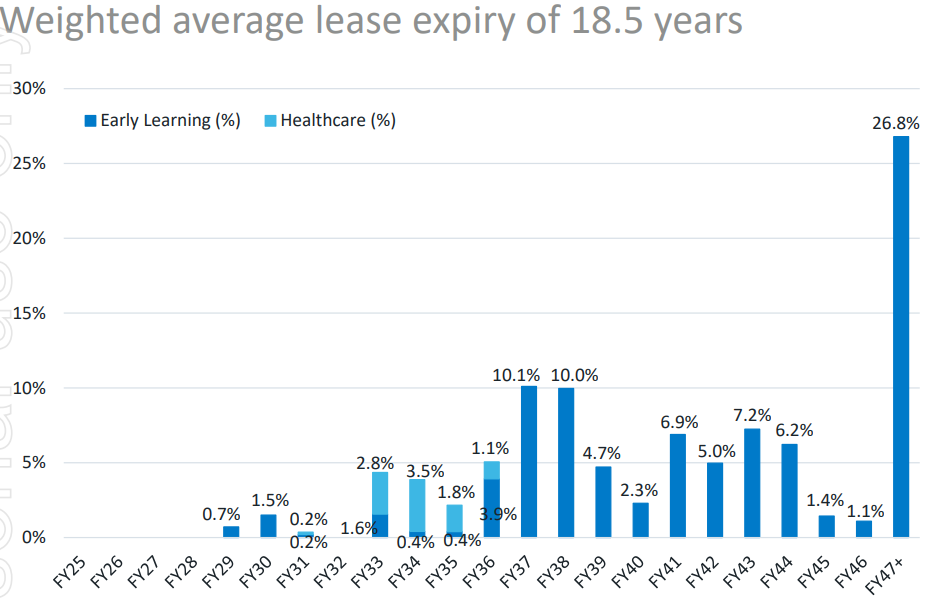

- Profits Up: Net profit increased by +5% to $62 million, driven primarily by a 5% increase in rents collected and completion of developments and acquisitions. ARF continues to have 100% occupancy and an average 19 years average weighted lease term, by far the best in the entire LPT sector, with less than 3% of lease expiring in this decade (See below).

- Distributions Up: ARF increase distributions by 4% to 17.4 cents per security, representing a payout ratio of 99%.

- Recent Acquisitions: In Jul, ARF completed a $140 million equity raising to buy six early childhood centres and four development sites across NSW on attractive 6% yields and average lease terms of 14 years. Alongside these acquisitions, the equity raise allowed AFR to pay down $25 million in debt off their balance sheet.

- Strong Balance Sheet: Following $25 million of debt being paid off from the equity raise, ARF’s gearing sits at 20%, with 81% of the debt hedged over the next 4.2 years. ARF continues to remain conservatively geared than loan covenants of less than 50% and 2x interest coverage (currently 5x).

- Regulatory Beneficiary: To boost early childcare staff availability, the labour government has agreed to a 15% wage increase for early childcare workers for services that agree to limit daily fee increases to 4.4%. This wage increase will ultimately benefit ARF with more financially stable tenants and demonstrates the underlying demand for the assets that ARF provides.

- Outlook: ARF management reaffirmed FY25 distribution guidance of 18.25 cents per security, representing a +5% increase on FY24 distribution.

Portfolio Strategy: ARF is a well-managed company exposed to tenants offering very non-discretionary services such as child and healthcare, both of which enjoy bipartisan support. ARF pays a solid growing yield directly linked to inflation and is paid quarterly, providing regular cash flow to our investors. The next major set of lease expiries are in 2037 and 2038, so we have few near and medium-term concerns.

ARF finished up 3.3% to $4.06 – still below the magical $4.16 to participate in the SPP