Amcor (AMC) This morning, the world’s largest consumer packaging company announced its results for the full year of 2024, which was pleasing to see the business return to volume growth after several quarters of destocking from customers such as Pepsi and Gatorade. The HNW Growth Portfolio has a 5% & the Income a 3.7% weight to AMC.

Key Points:

- Profits and Volumes Up: Fourth-quarter profits increased by +8% to US$305 million, bringing the full-year earnings to over US$1 billion, slightly behind FY23 record result. This increase was driven by a return to volume growth primarily in their flexibles range, which increased by +3%, including meat, cheese, and personal care packaging. As AMC reports quarterly we were very pleased to see a solid Q4.

- Cost Cutting: This time last year, AMC began a cost-cutting initiative to make the business more effective. Since then, AMC has invested $110 million back into the business, which saw $35 million in cost savings this year, with $60 million to be invested next year to add another $20 million in structural cost savings. These cost savings were evident in this result with both flexibles and rigids earnings margins increasing.

- Strong Balance Sheet: AMC’s balance sheet remains strong with $6.1 billion net debt or 3.1x leverage, well within expectations of what this type of business can handle. This low leverage allows AMC to finish their buyback they announced last year, provide consistent dividends as well as chase M&A opportunities as the arise.

- Dividends Up: AMC announced a dividend of A$0.77 per share, representing +4% growth on 2023.

- Guidance: AMC management provided guidance for earnings next year to be between US$0.72 and 76 cents per share, representing +3-8% growth on FY24 driven by a much better outlook for volumes growth across the Amcor business.

- Why is the stock down? AMC was sold off on lower full-year earnings, which were down -7% compared to last year, but this was no surprise after reporting a weaker start to the year as customers reduced inventory. The key piece of news was a solid Q4 and good growth for FY25. This was a good result and like CSL on Tuesday we expected a strong share price performance today from a company growing dividends and guiding to a solid coming year. Atlas note than CSL was down by -4.5% on results day but has recovered those losses since then.

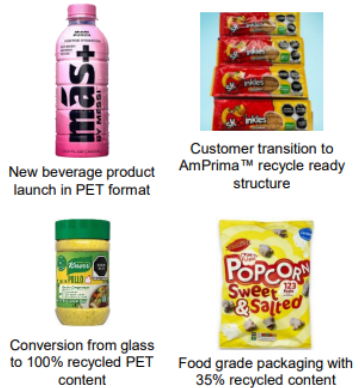

Portfolio Strategy: Amcor is the largest global packaging company with operations in 43 countries. While packaging is not the most exciting of industries, Amcor exposes the portfolio to global growth in consumer and medical goods and manufacturer demands for increasingly sophisticated packaging. 95% of AMC’s customer base is in consumer staples, such as packaging for meat, cheese, sauces and condiments, beverages, coffee, pet food, healthcare and personal care products, all of which have stable defensive characteristics. AMC has very little chance of being made redundant by new technologies, was the chance of clients delivering drink in plastic cups or food and medicine in paper bags very remote, in fact packaging becomes more complex each year to extend shelf life and prevent tampering. AMC trades on a PE of 13x with a full-year dividend yield of 5.5%

AMC finished down -3% to $15.69, despite this fall, AMC has been a solid citizen in the portfolio over the past year, up +13% vs the ASX200 +6%.