Commonwealth Bank (CBA) reported its full-year results for the 2024 financial year which were better than expected. Though due to the run up in the company’s share price since May ($110 to ~$135) any disappointment would have been treated harshly. Due to the breadth of its lending activities touching every sector, CBA is watched very closely for a read on the broader Australian economy’s health. The HNW Growth and Income Portfolios both have an 8.5% weight to CBA.

Key Points:

- Profits Slightly Down: Cash Profit was slightly down by 1% to $9.8 billion, and above market expectations. Operating income for the half was slightly higher due to higher volume and margin mix but was offset by higher wage inflation. Across the bank’s businesses, the powerhouse retail bank was solid, as expected, with the bank group ROE remaining strong at 13.6%.

- Net Interest Margin Up!: Over the half, CBA’s NIM actually increased to 2% from 1.99%, driven primarily by higher earnings on capital. This was a great result when many thought interest margins were going to compress from mortgage pressure in line with what the other major banks reported in May.

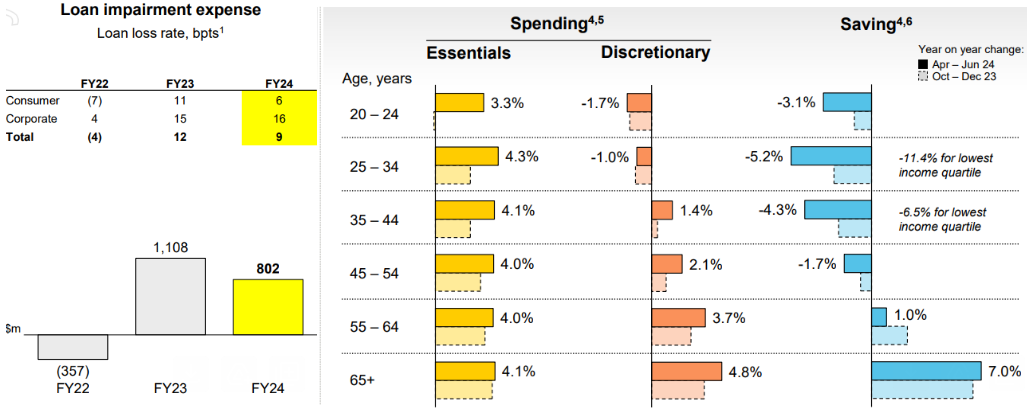

- Bad Debt Remains Low: Comprising only 0.09% of gross loans and well below the long-running average of 0.3% (see below). While unemployment remains low, Atlas expects banks’ loan losses will remain low, particularly when much of the more “exciting” high yield credit is not on bank balance sheets but rather with Private Credit Funds a new development from the last downturn during the GFC see: https://www.afr.com/companies/financial-services/overdue-loans-swamp-private-credit-giant-lending-to-sydney-s-wealthy-20240807-p5k0cn

- Dividend up: CBA announced an interim fully franked dividend of $4.65, representing a 3% increase on last year and a payout ratio of 79%. CBA also announced that they would fully neutralise their Dividend Reinvestment Plan (DRP), meaning current investors are not being diluted as CBA will buy roughly $400 million worth of CBA shares before giving them to investors

- The Blunt Instrument of Monetary Policy: CBA always gives a good read on how the whole economy is holding up, with this morning being no different. Within the first few slides of the presentation, CBA highlighted how higher interest rates don’t affect everyone differently, with older people spending and saving more than ever with younger cohorts spending and saving less. (See Below)

CBA finished up +1.3% to $134.21.

Portfolio Strategy: Our positive investment view towards Australia’s premier retail bank has not changed, with this result being in line with our expectations. What to do with the banks in 2024 has been a key question for investors, with bank shares very volatile as investor emotions swing from euphoria to despair. This result showed the resilience of the CBA’s key profit centre retail banking services, as high employment and a cleaner corporate loan book than in 1991 or 2007 will see lower bad debts (and higher profits) than the market expects. CBA is a well-capitalised Australian bank with a Tier 1 ratio of 12% after the FY24 dividend and most of a $1 billion buy-back ($720 million) still to go.