Charter Hall Retail REIT (CQR), the convenience retail real estate manager, posted strong earnings this morning, demonstrating the resilience of retail operators in Australia. The HNW Income has a 3.5% weight to CQR.

- Strong Operating Earnings: Operating earnings increased by 2% to $167 million, driven by their convenience long WALE retail portfolio which saw its earnings increase by 6.2%. This portfolio has the addition of 3 new portfolio from Gull (New Zealand), Z Energy (New Zealand) and Endeavour Group which all have WALEs over 11 years and triple net leases. Supermarkets continued to demonstrate resilience with 4.3% rental growth with 67% of supermarkets in turnover.

- Occupancy Remains High: 98.6% of the portfolio is currently occupied with 38% of the major tenants having CPI linked rent reviews and 35% being triple net leased, meaning the tenant pays all the property expense not Charter Hall.

- Distributions Up Strongly: Distributions increased by 5.3% to 25.80 cents per unit reflecting the end of COVID-19 tenants support and proportion of income from capex efficient triple net leased assets. Management also increased the payout ratio from 86% to 90%.

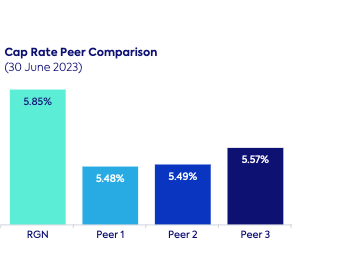

- Discount-to-NTA: CQR NTA fell by 3.7% to $4.73 after 87% of the book was revalued at the end of June, representing a 26% share price discount. The discount comes after CQR was able to sell 3 assets worth over $250 million at or above book value and suggests that the market is being to pessimistic towards CQR.

- Outlook: CQR have given guidance for FY24 and they expect operating earnings to be approximately 27.4 cents per unit and a payout ratio of between 90-95%, reflecting a distribution between 24.7-26.0 cents per unit. This equates to a 7.2% forward yield for CQR.

CQR finished down 1.4% to $3.52, on a day when the LPT sector was down.