Commonwealth Bank (CBA) reported its half-year results for the 2024 financial year, which were very solid, as expected. Due to the breadth of its lending activities touching every sector, CBA is watched very closely for a read on the broader Australian economy’s health. A “vanilla” result from CBA with very low bad debts. The HNW Portfolios have a a 9% weight to CBA.

Key Points

- Profits Slightly Down: Cash Profit was slightly down by 3% to $5 billion, in line with market expectations. Operating income for the half was slightly higher due to higher volume and margin mix but was offset by higher wage inflation and software amortisation. Across the bank’s businesses, the powerhouse retail bank was solid, as expected. Still, for us, the highlight was the business bank that contributed an additional $1.9 billion in profits due to increased lending and lower costs. This suggests that CBA has taken market share. ROE remains the best of the Aussie banks at 14%.

- Net Interest Margin: CBA’s Net Interest Margin (NIM) was lower to 1.99%, falling from 2.05% in June.

- Volumes vs Pricing: Although the NIM was lower this half, it is still currently much higher than other majors due to CBA not fighting for less profitable mortgages. Currently, the major banks minus CBA are trying to maintain deposits by offering high-interest term deposits whilst offering lowering mortgage rates as the cash rate looks to be at the cycle’s peak.

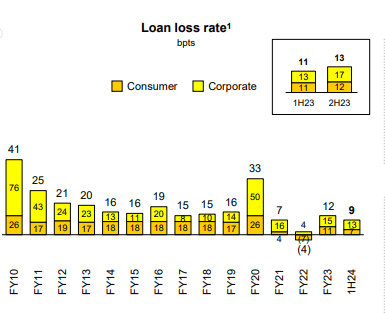

- Bad Debt Remains Low: Comprising only 0.09% of gross loans and well below the long-running average of 0.3% (see below). While unemployment remains low, Atlas expects banks’ loan losses will remain low. Looking through CBA’s result the consumer and Australian businesses appear to be handling rising interest rates. We were surprised to see offset account balance increase by $5 billion since June to $63B, conventional wisdom would have suggested that these would have fallen with rising mortgage rates.

- Dividend up and neutralised DRP: CBA announced an interim fully franked dividend of $2.15, representing a 5-cent increase on last year and a payout ratio of 72%. CBA also announced that they will fully neutralise their Dividend Reinvestment Plan, meaning current investors are not being diluted.

- Buyback to Continue: $154 million worth of the $1 billion buyback announced in August has been completed, with the rest set to be completed before May. The difficulty for CBA to complete this buyback is that between blackout periods and buying stock to neutralise the DRP, there is not much time for the on-market buyback. This should support the share price over the coming months.

Portfolio Strategy: Our positive investment view towards Australia’s premier retail bank has not changed, with this result being in line with our expectations. What to do with the banks in 2024 has been a key question for investors, with bank shares very volatile as investor emotions swing from euphoria to despair. This result showed the resilience of the CBA’s key profit centre retail banking services, as high employment and a cleaner corporate loan book than in 1991 or 2007 will see lower bad debts (and higher profits) than the market expects. CBA is a well-capitalised Australian bank with a Tier 1 ratio of 12% post the FY23 dividend and most of a $1 billion buy-back still to go.

CBA finished down -1.7% to $114, on what was a bad day in the market dominated by a strong US CPI number overnight.