CSL (CSL) reported their half-year 2024 profit results, which came in with mixed results but benefitted from stronger plasma collections and a strong USD, which is a positive for Australian investors and one of the reasons why we own the stock. However, we are disappointed with the results of CSL112. The HNW Equity Portfolio holds a 9.5% weighting to CSL.

Key Points:

- Record First-Half Profit: up +20% to US$1.95 billion, driven by a strong half for the immunotherapy division, which saw a 14% revenue increase, delivered by a decrease in cost per litre of blood. CSL’s vaccine division posted a 2% increase in revenue to $1.8 billion following a soft vaccination period in the Northern Hemisphere as consumers suffer from vaccine fatigue from the pandemic. Vifor was once again strong after being acquired by CSL in 2022, delivering sales of US$1 billion and US$450 million of profits, a high-profit margin (45%) business that can grow fast with a suite of products in the R&D pipeline.

- RIKA System Roll-out- more efficient vampires: Over the next 18 months, CSL will roll out their RIKA Plasma Donation System across all its blood collection centres. This is a significant benefit to CSL as the system reduces the donation time by 30% but improves the yield by 10%, leading to a 10% reduction in costs per litre of blood.

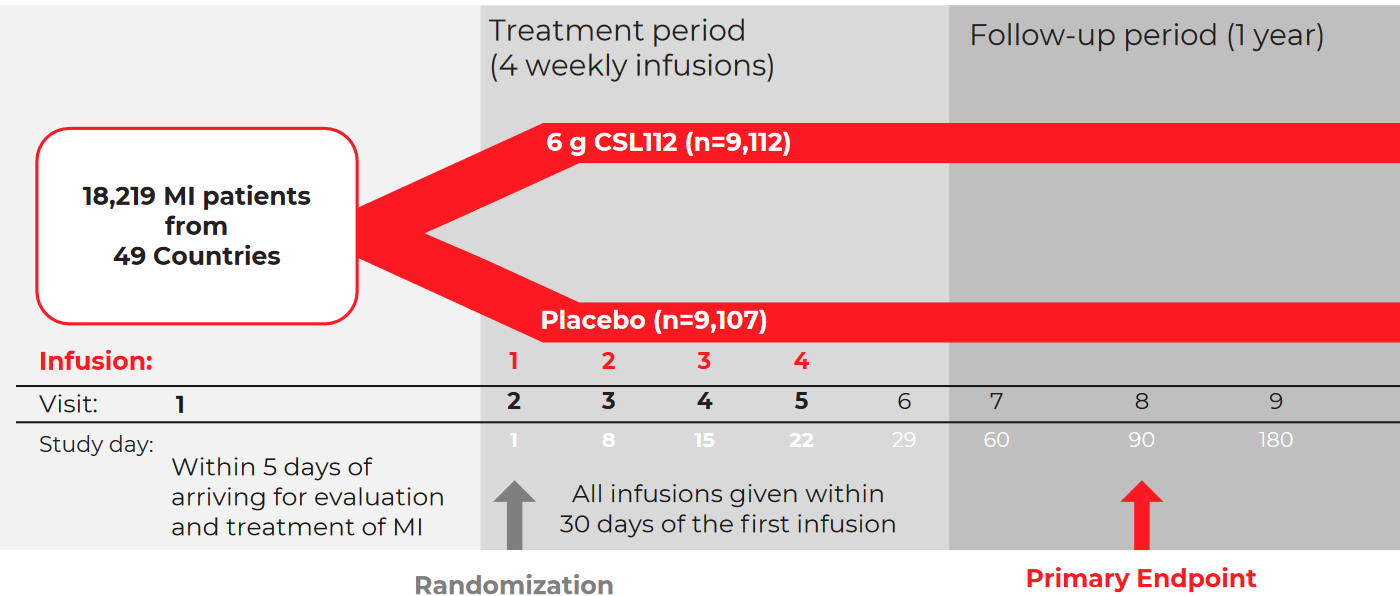

- CSL112: studies the drug has reduced the incidence of secondary heart attacks, strokes and death (post initial heart attack) after 90 days, but not to the extent that CSL expected, and the preliminary review of the data suggests that the drug may not be commercialised (see below table), i.e. not strong enough for governments and private health insurers to pay for the drug. They are reviewing the data with the final studies presented on 6th April. This is disappointing, but it was not in our base valuation of CSL. On a positive note, CSL has been expensing R&D costs through their P&L rather than capitalising them on the balance sheet (as most companies do), so this does not result in a write-off. Unfortunately, not all drug tests are commercial successes.

- Dividends up: +12% to A$1.81 per share, representing a payout ratio of 30% as CSL is expensing a current R&D spend through the P&L and not capitalising it as an asset on their Balance Sheet as other ASX peers do, the cleaner option in Atlas opinion.

- Guidance: CSL management reaffirmed their guidance for FY24 of 9-11% revenue growth and profits of US$2.9-$3 billion, as plasma margins continue to improve and with the seasonality of CSL, profits are weighted to the first half of their reporting year.

Portfolio Strategy: CSL is a world leader in manufacturing medicines from human blood and flu vaccines and, along with Sonic Health, are the Portfolio’s core healthcare positions. The business enjoys substantial barriers to entry with stable margins and, in Australia, enjoys exclusive rights to the production of blood plasma-derived medicines. The company earns over 90% of its profits offshore and benefits from a falling AUD. Key catalysts over the next 12 months will be returning the Behring IG margins back to pre-pandemic levels, which will see double-digit growth across the business over the medium term.

Essentially the cake (core business) performing well but no icing (CSL112) today.

CSL finished down 2.7% to $282.25