Amcor (AMC) This morning, the world’s largest consumer packaging company announced its results for the third quarter of 2025, highlighting the strengths the merger with Berry will achieve in the long term. The HNW Portfolio has a 4.3% weight to AMC.

Key Points:

- Profits Up: Over the quarter, net profit after tax was up +4% to US$196 million. Overall volumes were in line with last year, albeit with a better price/sales mix due to a higher weighting to value healthcare, fresh and frozen foods, meat and liquid flexible packaging. The North American beverage business saw volume declines, which were offset to come extent by Lat Am and specialty containers.

- Trump Tariffs: Management said that customer confidence has fallen in USA beverages, not flexibles, since the tariffs were announced, but AMC’s business itself is not impacted by Trump’s tariffs.

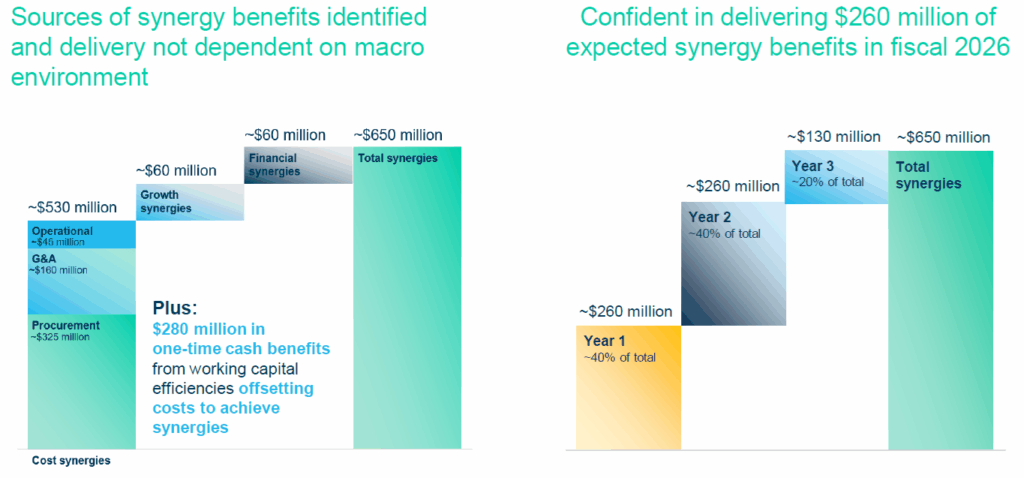

- Berry Merger: The merger with Berry has closed, and integration has started, with $260M synergies expected in FY26 and a clear path to $650M annual synergies by year 3, mainly from procurement. Despite Amcor’s strong track record of achieving synergies from major acquisitions such as Alcan and Bemis, the call saw sell-side analysts sceptical that management could generate many synergies from cheaper resin procurement. Atlas had the opportunity to meet with AMC’s CEO in February, and after pushing him hard on the details, we are comfortable with the EPS growth being achieved.

- Dividend: AMC announced a dividend of A$0.20 per share, representing +3% growth in the third quarter of 2024.

- Why is the stock off? Concerns about North American beverage volumes and analyst doubts about whether synergies can be achieved.

- Guidance: AMC management narrowed its guidance for earnings this year to be between US$0.72 and US$0.74 per share, representing 3-6% growth in FY24. AMC also announced that it expects a +12% increase in earnings per share following synergies with the Berry acquisition alone. The specific nature of this guidance rather than vague claims that the merger will add value, gives us comfort that the targets will be achieved.

Portfolio Strategy: Amcor is the largest global packaging company with operations in 43 countries. While packaging is not the most exciting of industries, Amcor exposes the portfolio to global growth in consumer and medical goods and manufacturer demands for increasingly sophisticated packaging. 95% of AMC’s customer base is in consumer staples, such as packaging for meat, cheese, sauces and condiments, beverages, coffee, pet food, healthcare and personal care products, all of which have stable defensive characteristics. AMC trades on a PE of 11x with a full-year dividend yield of 5.5%.

Despite the adverse share price moves, we were pleased with this update, especially the +12% growth EPS guidance for FY26. AMC has a good long-term track record of integrating packaging businesses and has the same team that worked on Alcan and Bemis, working on the Berry merger.

AMC finished down -3.9% to $14.04