Westpac Banking Corporation (WBC) released its half-year results for 2025, which came in line with market expectations. Westpac is the first of the big four banks to report their full-year results this season, with ANZ and NAB later this week and CBA reporting their third-quarter results next week. The HNW Portfolio holds a 7% weight to WBC.

Key Points:

- Profits Up: Net profit remained flat at $3.3 billion with increases in interest income offset by increased spending on technology including WBC UNITE program which is expected to bring $15 million in savings per year in coming years. Although total profit was flat, WBC benefitted from its on-market buyback program, which increased earnings per share by 5% on last year.

- Low Bad Debts: Bad debts are nowhere to be seen in Westpac’s results, with a mere 0.06% of loans currently being impaired. Atlas continues to believe that the “riskier” loans now sit with unregulated private credit funds rather than the banks, which have to hold capital against the loans.

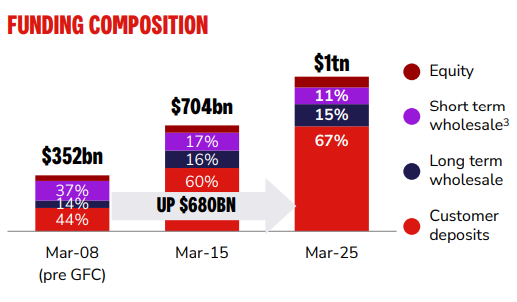

- Not the banks of old: The funding for Westpac’s loans has changed drastically since 2008, with customers’ deposits growing from 44% of the funding structure to 67% (See Below). This has seen the banks decrease their dependence on short-term wholesale overseas money from 37% to 11%, significantly decreasing the banks’ exposure to risks in a market slowdown.

- Strong Capital Funding: Westpac currently has a capital ratio of 12.5%, well above its long-term target range of 11.5%. This gives it plenty of leeway to complete its remaining $1.1 billion on-market share buyback. Since the start of 2021, WBC has decreased its outstanding shares by 7%.

- Show me the Money: WBC announced a 1% dividend increase to $0.76 per share fully franked, representing a payout ratio of 75% of profits.

- Guidance: Westpac management did not provide explicit guidance for next year due to fast-evolving capital funding costs but did state that they expect to grow in line with other banks across their mortgage and business loan books.

The share price was off on a weaker than expected net interest margin, to competitive pressures, as always WBC’s performance has to be judged compared with its peers that report later this week. Where WBC proves to have navigated the period better than its peers the stock will rally.

CEP Strategy: This was a solid result from Westpac, with the business travelling well. We own WBC in the portfolio due to its heavy exposure to mortgages which comprise 69% of WBC’s loan book. Through the cycle, mortgages have historically had much lower bad debt charges than business lending due to Australia’s home loan recourse lending and higher margins. We expect loan losses to remain low or slightly increase going forward, which will offset the more dormant net interest margins. We remain happy holders of the bank, which trades on a PE of 15x with a 5% dividend yield.

Westpac fell -3% to $32.45. WBC has been a solid citizen in the portfolio up +29% over the past year.