This morning, Ampol (ALD), Australia’s largest energy distributor and retailer, released strong first-half results. The result shows that ALD’s various businesses are all performing well (see below table), with most divisions ahead of where they were pre-pandemic. The HNW Portfolios have a 4% weight to ALD.

Key Points:

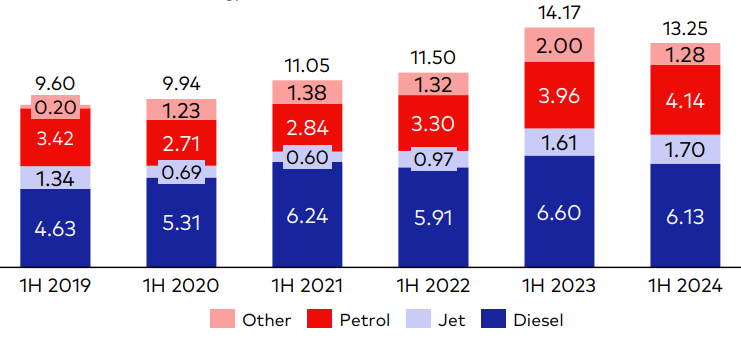

- Profits Down: Ampol’s first-half profits were down by 29% to $234 million, driven primarily by a 26% fall in Fuels and Infrastructure following a less volatile six months leading to lower international fuel sales. Convenience Retail earnings were up by 5% to $175 million, driven by strong growth in shop margins from increased promotional mix. Z Energy in New Zealand continues to prove it was a good acquisition, with earnings growing by 4% to $128 million, driven by increased fuel margins and exiting non-core businesses to reallocate capital more efficiently. Refining margins US$10.27 per barrel still high but not the stratospheric levels seen in 2022/23.

- Lytton Refinery: Earnings were down 11% for the half following an unexpected outage at the refinery in the first quarter, during which a catalyst broke. The disruptions in the Red Sea earlier amplified the outage, causing the new part to be delayed another week.

- Strong Balance Sheet: The Ampol balance sheet remains strong with a net debt of $2.6 billion or 1.9x leverage, below the target leverage range of 2-2.5x. This allows ALD to keep paying dividends whilst looking at M&A activity as they arise.

- Dividend Down: ALD announced a fully franked 60 cents per share dividend, down 37% on last year. Dividends were down on last year due to lower earnings but also a lower payout ratio (61% vs 69% last year) as Ampol completes construction on its new highway sites.

- Outlook: Ampol management did not provide specific detail on the outlook but did say they expect continued strong fuel sales in Australia and noted that Lytton refiner margin would be impacted in the third quarter as it undergoes turnaround and inspection but would return to normal operations by the end of August.

ALD finished down -4.8% to $30.54 a big reaction to a cut in the dividend payout ratio.

Portfolio Strategy: ALD is the core energy exposure in the Portfolio but with greater exposure to fuel and food retailing rather than the vagaries of the oil price. Over the past five years, ALD has changed from a capital-intensive business with volatile earnings dependent on global refining margins to one increasingly based on fuel and convenience retailing and bringing franchised service stations in-house. ALD trades on an undemanding = 16x forward earnings with a 5% fully franked dividend yield. The return of suitors EG or ACT would be positive share price catalysts, especially with the government underwriting refining profitability and giving the company $125 million to improve their assets to produce ultra-low sulphur petrol. We were pleased to see ALD rolling out 220 EV fast charging bays across 85 sites, this not only provides ALD with an additional revenue source ($20-$40 per charge for 10-15 minutes = $24M profit) but positions the company for the future.