This morning, Westpac Banking Corporation (WBC) provided a first-quarter update, which came in above market expectations. We usually don’t comment on trading updates as they are too volatile and can give a misleading picture, both positive and negative, but today’s share price move warrants a brief note. The HNW Portfolios holds a 6.5% weight to WBC.

Key Points:

- Mortgage Portfolio: Net profit increased by 6% to $1.8 billion for the quarter, driven by cost management which only saw expenses increase by 2% for the year, well below the current inflation rate. WBC also saw an increase of 6% in loans to $800 billion, and deposits increased by 5% to 666 billion.

- Net Interest Margin: Remained flat for the quarter at 2.00%, excluding movements from interest rate hedging, a very good outcome.

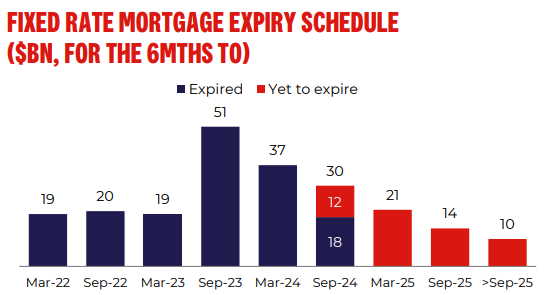

- What Fixed Rate Cliff? 89% of the WBC loan book is now on a variable interest rate, up from 76% in September last year. The majority of the remaining 11% fixed rates will roll off by March 2025. (See Below)

- Low Bad Debts: followed the CBA trend from last week and decreased by 0.09% to 0.04% of gross loans, well below the 0.3% pre-pandemic average.

- Capital Ratio: WBC’s capital ratio, at 12%, remains above the bank’s target operating range. Depending on their fourth quarter, more on-market share buybacks could be announced at the full-year result.

WBC rose +2.5% to $30.40.

CEP Strategy: This was a solid result from Westpac, with the business travelling well. We own WBC in the Portfolio due to its heavy exposure to mortgages, which comprise 65% of WBC’s loan book. Through the cycle, mortgages have historically had lower bad debt charges than business lending due to Australia’s home loan recourse lending and higher margins. While we expect loan losses to increase, higher net interest margins will offset this. We remain happy holders of the bank, which trades on a PE of 14.5x with a 5.9% fully franked yield. Controlling costs was a highlight in the current inflationary environment.