This morning, Suncorp (SUN), the Queensland-based insurer and bank operator, delivered a strong result, continuing its strong performance from the first half. The HNW Portfolios have a 3% weight to SUN.

Key Points:

- Record Profits: Suncorp has continued to grow profits through 2024, posting cash earnings of $1.4 billion, an increase of 12% on last year. This follows a strong performance of its general insurance arms, which saw profits increase by 29%. Australian consumer insurance profits increased by over 100% following double-digit unit growth in home and motor insurance and benefits from lower claims and expenses.

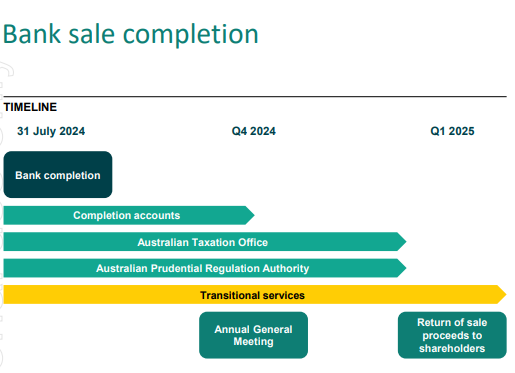

- Sale of Suncorp Bank: Suncorp Bank’s sale was completed in July, with total net proceeds of $4.1 billion after selling the bank to ANZ. Suncorp management reiterated that they plan to return the majority of the sale proceeds to shareholders primarily through a capital return and a smaller, fully franked special dividend. (See Below)

- Increased Investment Income: Suncorp’s earnings on its $16.4 billion investment float increased to $661 million, representing a 47% increase from last year’s following more attractive investment yields. Similarly to QBE and Medibank Private higher interest rates give a tailwind to profits for insurers

- Increased Dividends: SUN announced a 44-cent per share fully franked dividend, representing a payout ratio of 72% of earnings and a 30% increase on last year’s dividend.

- Outlook: Management has guided for average GWP growth of mid to high-single digits as claims inflation, commodity prices and global reinsurance markets continue to stabilise throughout the next year.

CEP Strategy: SUN is a diversified insurance and banking group, but soon to be a pure domestic insurer. We are attracted to SUN as it gives the portfolio exposure to rising insurance premiums across Eastern Australia as well as higher interest rates. We have preferred SUN over IAG as our domestic insurance exposure as it is much cheaper, and we like the potential for further capital returns. SUN trades on 14x forward earnings with a 4.5% yield.

SUN finished up +1.3% to $17.41.