Westpac Banking Corporation (WBC) released its full-year results for 2024, which came in line with market expectations. Westpac is the first of the big four banks to report their full-year results this season, with ANZ and NAB later this week and CBA reporting their third-quarter results next week. The HNW Portfolios both hold a 7.5% weight to WBC.

Key Points:

- Profit Down Slightly: Net profit decreased by 3% to $7 billion, driven an increase in net interest margins offset by increased spend on technology including on WBC’s UNITE program which is expected to bring up to $15 million in savings per year. What was very pleasing for us was the improvement in 2H of 2024 with profits up 9% on the first half due to lower impairments and a stronger profit margin.

- What Bad debts?: WBC reported an impairment charge of a mere 0.07%. It will be interesting to see what impairment charges are reported by the private credit funds over the next six months, with some of the more “exciting loans” that traditionally caused problems for the banks clearly sitting elsewhere in the financial system.

- Resilient Net Interest Margins (NIM): Westpac’s NIM (Loan payments minus deposit costs) remained resilient over the half, increasing by 0.03%. Whilst this sounds very insignificant, this increased Westpac’s income by $214 million over the second half when applied over a loan book of $807 billion!

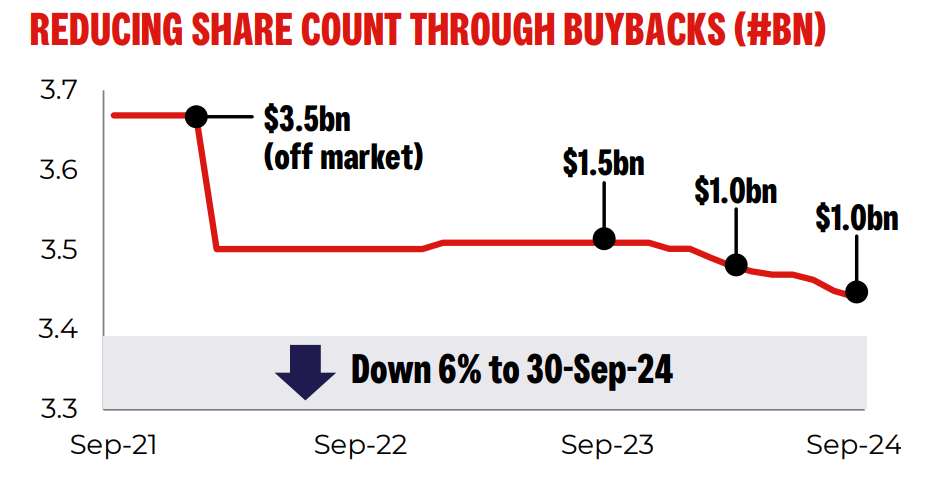

- Strong Balance Sheet: Westpac currently has a capital ratio of 12.5%, well above its long-term target range of 11.5%, which will see it increase its on-market share buyback from $2.5 billion to $3.5 billion. (See Below) Since the start of 2021 WBC has decreased their outstanding shares by 6%.

- Show me the Money 1: WBC announced a 4% dividend increase to $0.75 per share fully franked, representing a payout ratio of 71% of profits.

- Show me the Money 2: WBC announced an additional $1 billion on market share buy-back. This will see the bank buy back $1.75 billion of shares in the near future.

- Guidance: Westpac management did not provide explicit guidance for next year but did state that they expect to grow in line with other banks across their mortgage and business loan books. WBC also highlighted that they are still above the recommended target capital ratio range after including the new buyback, which could see further capital returned to shareholders.

WBC finished up 1% to $32.40 and has been an exceptionally strong citizen in the Portfolio up +58% over the past year.

CEP Strategy: This was a solid result from Westpac, with the business travelling well. We own WBC in the portfolio due to its heavy exposure to mortgages, which comprise 63% of WBC’s loan book. Through the cycle, mortgages have historically had much lower bad debt charges than business lending due to Australia’s home loan recourse lending and higher margins. We expect loan losses to remain low or slightly increase going forward, which will offset the more dormant net interest margins. We remain happy holders of the bank, which trades on a PE of 17x with a 5% dividend yield, with share prices being supported by billion dollar buy-backs.