Amcor (AMC): This morning, the world’s largest consumer packaging company announced its results for the first quarter of 2025. It was pleasing to see the business continue its volume growth from August. The HNW Growth and Income Portfolios have a 4% weight to AMC.

Key Points:

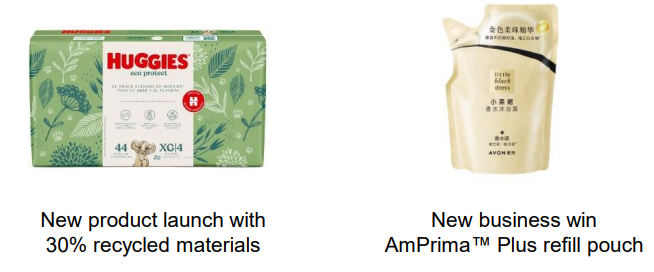

- Profit and Volumes Up: First-quarter profits increased by 5% to US$193 million, driven by a continuation of volume growth primarily in their flexibles range, which increased by 3%, including meat, cheese, and personal care packaging. Healthcare packaging was off a bit due to de-stocking.

- Successful Cost Cutting: It was clear in this result that Amcor’s cost cutting of last year is showing dividends with total sales down due to deflation of input costs but earnings actually grew over the quarter. The saw earnings margins increase by 0.5% to 10.9%.

- Strong Balance Sheet: AMC’s balance sheet remains strong with $6.9 billion net debt or 3.5x leverage, well within expectations of what this type of business can handle. But net debt will decrease in the coming year with the proceeds from the Bericap JV being used to pay off debt.

- Dividends Up: AMC announced a dividend of US$0.1275 per share, representing +2% growth in the first quarter of 2024.

- Guidance: AMC management reaffirmed guidance of full-year earnings next year to be between US$ 72 and 76 cents per share, representing 3-8% growth in FY24.

- Why is the stock down? The stock is off today due to lower-than-expected volumes in the quarter, but Amcor is a seasonal business with the first quarter of every year used to build inventory which results in lower sales and volumes, as most north American beverages are consumed during the spring and summer months.

AMC finished down -4.3% to $16.01, similar to MQG, Amcor has been a solid contributor to performance up +17% in 2024.

Portfolio Strategy: Amcor is the largest global packaging company with operations in 43 countries. While packaging is not the most exciting of industries, Amcor exposes the Portfolio to global growth in consumer and medical goods and manufacturer demands for increasingly sophisticated packaging. 95% of AMC’s customer base is in consumer staples, such as packaging for meat, cheese, sauces and condiments, beverages, coffee, pet food, healthcare and personal care products, all of which have stable defensive characteristics. AMC trades on a PE of 16x with a full-year dividend yield of 5%.