Macquarie Group (MQG): This morning, the global investment bank reported its full results for 2025, which were solid despite the half having much fewer investment banking deals and increased volatility in the marketplace. Overall, a solid result from the vampire kangaroo and provides the solid recovery from the $170 share price seen a mere 30 days ago where the prevailing narrative was that MQG would disappoint in May. HNW has a 6.5% weighting Macquarie Group.

Key Points:

- Record Profits yet again: Full year profits up +5%, driven primarily by Macquarie Asset Management and Banking and Financial Services, which benefited from strong public market returns and growth in home loans. More pleasing was the acceleration in profits in the second half which was up +30% on 1H and assisted by the sale of Macquarie Rotorcraft helicopter leasing business.

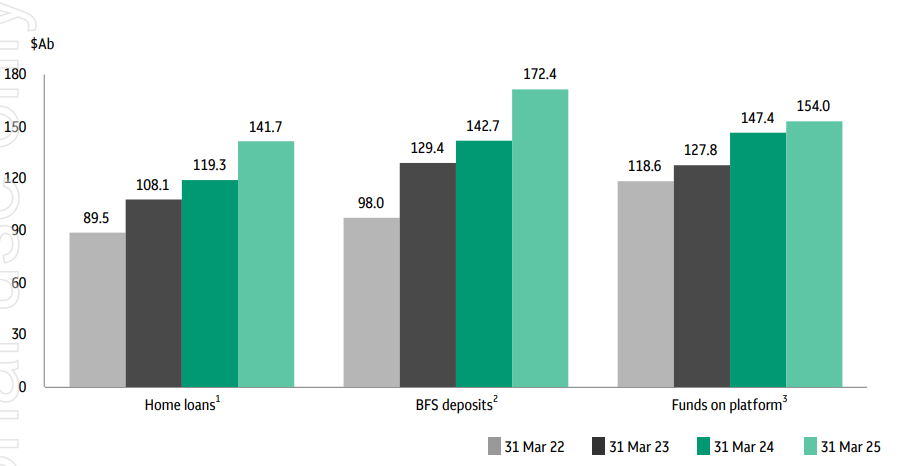

- Banking not boring: Profit from the domestic bank increased by 11%, driven by a 19% increase in their home loan portfolio to 6% of Australian mortgages (See Below). Similarly, bank deposits increased by 21%, which provides Macquarie with funding flexibility across its balance sheet. Macquarie’s organic growth strategy in banking continues to surprise, with MQG strategy of “we don’t want all the bank’s customers just the best ones” working.

- Solid Balance Sheet: MQG currently has a solid capital ratio of 12.8%, which is well above the APRA minimum capital target requirement of 11.5%. This leaves MQG in a great position to support both growth in assets and returning capital to shareholders. The bank has $27.9 billion in excess capital to deploy globally at the start of FY26 and is hunting for deals.

- Dividends Up: Macquarie management announced a dividend of $6.50 (35% franked), representing a +2% increase on the 2024 dividend, this represents a low payout ratio of 66%. In combination with the dividend and employee share plan which will both be neutralised by buying $650M shares on market, Macquarie still has $1 billion in on-market share buybacks to complete. This will support the share price in the near term.

- Guidance: Macquarie management did not provide any full year guidance for any of the businesses but did state that they remain with a cautious stance for global markets and well positioned to respond to a change in the current environment. A cut and paste from last years guidance.

MQG offers investors both the “cake” of stable annuity-style profits from asset management to go with the “icing”, that is, the more volatile earnings that are derived from investment banking and trading in commodities and financial markets. MQG trades on an undemanding PE of 16x with a 4% yield and is navigating choppy waters well.

Macquarie finished by 4% to $203.31 driven by the continued growth in the banking business.

CEP Strategy: Atlas’ biggest bank overweight exposure is Macquarie Bank, which offers exposure to a global investment bank with a heavy weighting towards stable funds management earnings and will benefit from a falling AUD. Unlike the major trading banks that operate in a competitive oligopoly where any moves to grow market share are swiftly matched by the other banks, Macquarie’s growth is not constrained by Australian GDP growth, with 65% of revenue coming from international markets.