ANZ Bank (ANZ) released their first half of 2025 results, which came in around market expectations with the acquisition of Suncorp Bank which has performed better than expected. ANZ is the last of the big four banks to report this season, with CBA to give their third-quarter update on Wednesday next week. The HNW Portfolio holds a 7% weight to ANZ.

Key Points:

- Profit Up: Net profit rose by +12%, to $3.6 billion driven primarily by lower costs initiatives, largely being offset by lower net interest margins (Interest received from home loans minus Interest paid for deposits) as mortgage competition continues to rise. Earnings per share up +13% shows the accretion from the Suncorp acquisition.

- Again Low Bad Debts: Bad debts continue to remain extremely low at 0.04% of gross loans. Similar to the other major banks that have reported this week, there is a clear emphasis on strong loan writing and customers in good health. Though some of their good fortune is due to APRA steering the banks away from more risky lending with the Basel III capital charges.

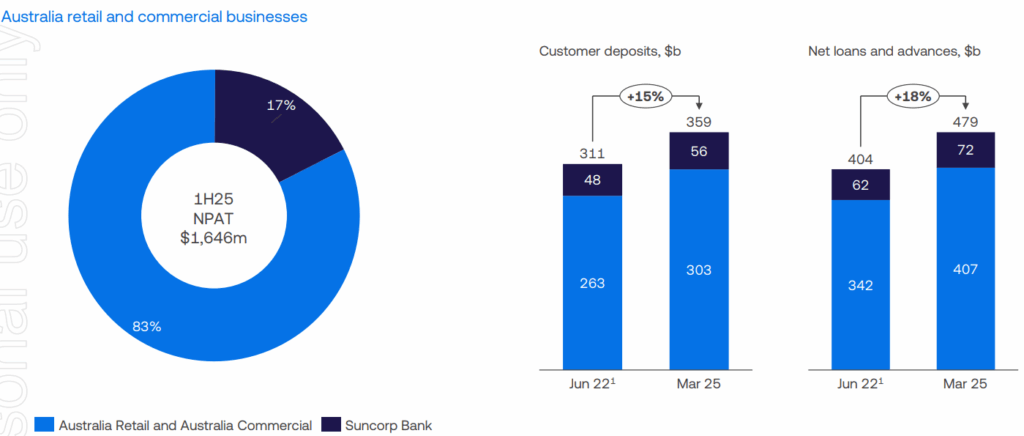

- Suncorp Strength: In July last year, ANZ completed its acquisition of Suncorp Bank, which saw Suncorp Bank boost ANZ’s market share in Australian mortgages by 2.5% to 16%. Pleasingly, since ANZ announced the acquisition of Suncorp in Jun 2022, the bank has been going from strength to strength and contributing 17% of ANZ’s Australian profit this half. (See Below)

- Strong Balance Sheet: ANZ currently has a solid capital ratio of 12.0% after the acquisition of Suncorp Bank, which is above the APRA minimum capital target requirement of 11.5%.

- Show Me the Money: ANZ’s dividend remained flat at $0.83 per share, 70% franked, representing a payout ratio of 69%, a bit on the low side for us given ANZ’s capital position. $800M remains on the on-market share buy-back.

- Guidance: ANZ did not provide any business guidance but noted that they are continuing to build out their new ANZ Plus offering, which will decrease costs and increase productivity over the longer term, when the app is fully rolled out to ANZ customers in 2027. Today was long-term CEO Shayne Elliot’s 18th and last set of results for ANZ and he hands the bank off to the new CEO in good shape.

ANZ finished down 2% to $29.40 – reflecting some disappointment that ANZ did not increase the interim dividend in light of higher earnings.

CEP Strategy: We own ANZ in the Portfolio on both valuation grounds and the tailwinds the bank will enjoy over the next few years as Suncorp Bank continues to be integrated into the ANZ system and increase ANZ market share as well as rationalising its branch network. While there has been much discussion in the press about bank valuations (particularly CBA), the May results season indicated to us that the banks may warrant a higher PE in the future than they have in the past. Simplification of their businesses and pulling back from foreign adventures has resulted in more predictable profits. ANZ trades on an undemanding PE of 13x and a dividend yield of 5.6%.