Dyno Nobel née Incitec Pivot (DNL): Today, the global fertiliser and explosives manufacturer reported their first half of 2025 results, which was pleasant to see management making prudent moves in selling assets. Changing tack from trying to sell the whole business to one buyer to selling it in more manageable pieces. The HNW Portfolio holds a 2.5% weighting to DNL.

- Solid Underlying Earnings: DNL posted an earnings decline of -18% to $156 million, mainly due to a 50% fall in fertiliser business earnings and upgrade to the explosive manufacturing plants. Due to the seasonality of the fertiliser business, only 10% of DNL profit is captured in the first half results, with the second half making up 90% of profit following the Australian winter cropping season.

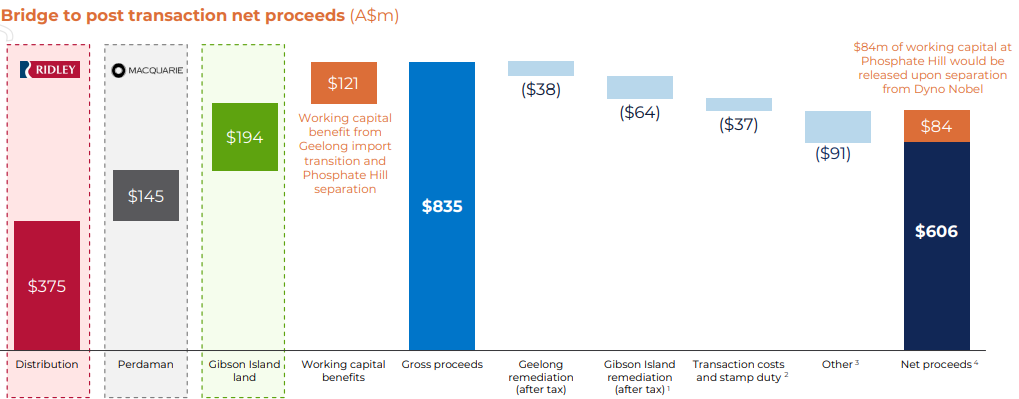

- Asset Sales: DNL announced the sale of three assets this morning. First, the Incitec Pivot Fertilisers’ distribution business was sold to Ridley for $375 million upfront and $125 million from working capital benefits. Secondly, the Perdaman offtake agreement was sold to Macquarie CGM for $145 million following the distribution sale. Lastly, the sale of Gibson Island land in Brisbane for $194 million, but DNL will have $92 million in remediation costs, bringing total proceeds to $100 million. Total assets sales are expected to bring in $690 million following the associated costs of divesting (See Below). Atlas is very pleased with the prices achieved by DNL, which were above our estimates – especially the $500M for the fertiliser distribution business.

- Capital Management: Excluding the recent asset sales, DNL still has an ongoing market buyback of $663 million, or 14% of outstanding shares, which will re-start tomorrow. This is on top of the $650 million IPL returned to shareholders last year from the sale of the Waggaman plant in Louisiana.

- Dividend: DNL management announced a 2.4 cent interim dividend, representing a 51% payout ratio.

- Strong Explosives Outlook: DNL is set to benefit from the US push to expand its coal mining operations, with DNL’s explosive manufacturing plant located in Wyoming near the Powder River Coal Basin. On the call management confirmed our view that the impact of the Trump tariffs are expected to be minor, with DNL manufacturing explosives in the USA to service American customers.

In the near term, we would expect DNL to re-rate higher as a pure explosives business similar to Orica, as selling the fertiliser will reduce earnings volatility. We would expect the above assets to result in a tax effective 40 cent per share return of capital later on in 2025

DNL finished up +2% to $2.62.

CEP Strategy: DNL is Australia’s largest manufacturer of fertilisers, supplying around 50% of the nation’s fertilisers, though not for much longer. Additionally, DNL is the world’s second-largest manufacturer of explosives used in mining, quarrying, and construction and the largest in the USA. DNL takes advantage of lower US natural gas prices via their new ammonia plant in Louisiana. DNL offers us exposure to a well-run global chemical company that benefits from US shale gas, improving demand for Australian agricultural produce and a falling AUD. DNL trades on 13x earnings and a dividend yield of 4%.