In August, the HNW Australian Equity Portfolio had a had a challenging month, finishing up +1.34% and behind the ASX 200 TR (ex LPT) return of 3.01%. A disappointing outcome over a month that saw significant volatility, with the average results day trading range of close to 8%. Overall, the reporting season was better than expected and showed that the domestic economy was in better shape than the global economy. Consumers are spending, and bank bad debts are still super low.

Over the month, positions in Mineral Resources (+31%), Westpac (14%), Lotteries (10%), Ampol (+9%) and Transurban (+6%) aided performance. On the negative side of the ledger, CSL (-21%), Sonic Healthcare (-13%), and Amcor (-11%) hurt performance due to small misses. All three companies have guided to > 10% earnings per share growth in 2026 yet were sold off heavily. Additionally, not owning BHP (+10%) hurt relative performance with the market excited about the steel consumption of a mega dam on the Yarlung Tsangpo River in Tibet. We see this as curious given the expect 2.4 million tonnes of steel needed for the dam is a rounding error in China’s annual 1BT steel production and will probably be made with iron ore sourced from China’s new mines in Guinea.

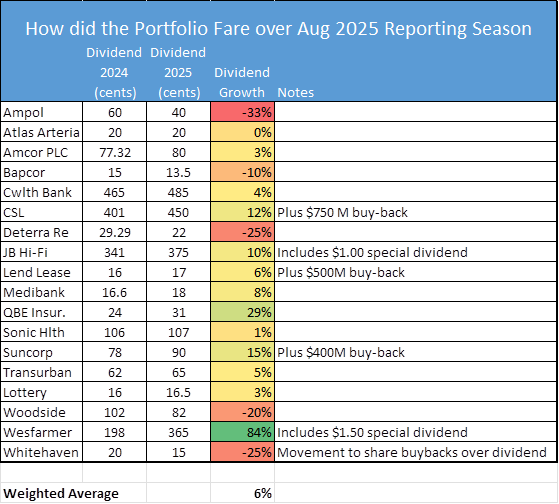

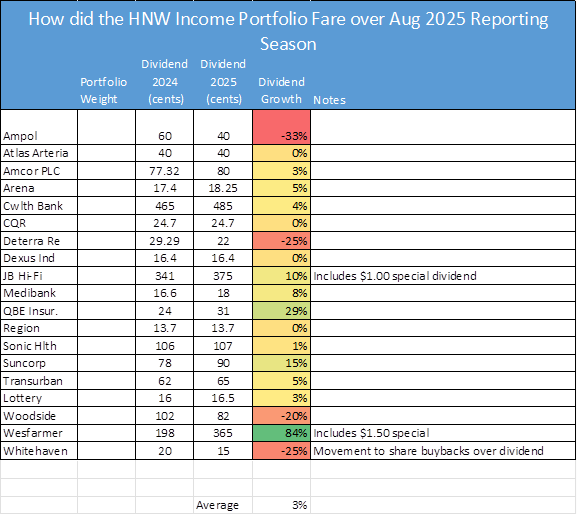

One of the key measures we use when assessing our performance during a reporting season is whether company boards are increasing dividends. We find that this removes some of the macroeconomic noise and future promises made by company management, which may or may not eventuate. Companies can restate reported profits due to accounting issues ( as the suspended Corporate Travel will do in September), but dividends cannot be clawed back. Additionally, a board declares dividends based on more detailed financial statements and forecasts than are available to investors; therefore, we view dividends as a signalling mechanism of earnings quality.

It was pleasing to see portfolio companies, on average, increase dividends by +6% in the August reporting season, ahead of the wider ASX 200 that saw a cut of -2%. Portfolio companies will be conducting on-market share buy-backs and giving our investors special dividends.

In August, the HNW Australian Equities Income Focus Portfolio had a consistent month +3.48%, ahead of its blended benchmark of +1.86%. At a very broad level the difference in performance is due to the Income portfolio not owning CSL and having a 10% allocation to REITs which all performed well in August. Over the month positions in Westpac (+14%), Ampol (+9%), Lotteries (10%), Arena REIT (+10%), ANZ Bank (+10%) and Charter Hall Retail(+8%) added value. On the negative side of the ledger performance was hurt by Amcor (-11%) and Sonic (-13%).

Income was healthy for the portfolio with 19 positions paying distributions, though with the positions held in the portfolio posting a small increase over their 2024 distributions. It was pleasing to see portfolio companies, on average, increase dividends by +3% in the August reporting season, ahead of the wider ASX 200 that saw a cut of -2%.

Full reports to follow shortly.