In September, the HNW Australian Equity Portfolio had experienced a challenging month, declining -2.65% and underperforming the benchmark return of -0.78%, primarily due to macroeconomic factors rather than the outlook for company profits in 2026. Investors were probably due for a weaker month for equities after an unusual period of five consecutive months of returns around +2%.

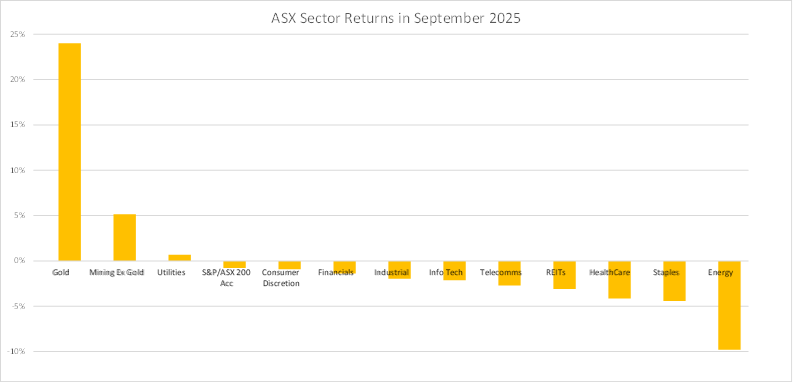

September was all about two commodities, gold and oil. The gold sector returned 24% in September, and not having an index exposure to gold would have contributed 1% to relative underperformance. Indeed, only three sectors — gold, mining (excluding gold), and utilities — posted positive returns over the month. All other sectors averaged a -3% pull back in September. We have been circumspect towards the gold stocks on the ASX due to the 1) lack of earnings, 2) minimal dividends yield, as well as 3) lagging the gold price (up 90%) over the last 18 months due to individual production issues.

The energy sector was weak over the month, not so much due to the modest decline in oil prices, but rather due to the Abu Dhabi National Oil Co. walking away from its $36 billion takeover offer for Santos (which we don’t own). This saw the entire sector sell off including Woodside which had nothing to do with the failed takeover.

Over the month, positions in Mineral Resources (+10%), Ampol (+2%), Dyno Nobel (+2%) and new addition Dalrymple Bay (+7% from initial investment 10/9) added value. On the negative side of the ledger positions in Woodside (-12%), Sonic (-8%), CSL (-6%), QBE (-5%) and Transurban (-5%) all hurt performance on no news. October has so far seen a large portion of these September falls recovered.

In September, for the same reasons detailed above the HNW Australian Equities Income Focus Portfolio declined by -2.58%, underperforming the blended benchmark return of -0.08%. Over the month, positions in Dexus Industrial (+3%), Ampol (+2%), Dyno Nobel (+2%) and new addition Dalrymple Bay (+7% from initial investment 10/9) added value. On the negative side of the ledger positions in Woodside (-12%), Sonic and Transurban (-5%) all hurt performance on no news.

Structurally the HNW Income Portfolio was not likely to own any gold stocks in 2025, with the highest yielding gold miners Northern Star (2.2% yield) and Newmont (1.17% yield) well below the Portfolio’s minimum yield threshold of >3% excluding franking.

Full reports to follow shortly.