CSL: This morning, the world’s leader in manufacturing medicines from human blood, gave a trading update at their AGM that came in below market expectations. We usually don’t comment on trading updates because they are too volatile and can give a misleading picture —both positive and negative —but today’s share price move warrants a note. The HNW Core Portfolio holds a 7.5% weight to CSL.

Key Points:

- Vaccine uptake declines: US flu vaccination rates for the upcoming winter flu season are looking to be down for the current Northern Hemisphere 25/26 season, based on insurance claims data to date. CSL now expect US vaccination rates to decline by 12% for the overall population and 14% for the 65+ age group vs last year. This vaccine hesitancy appears to be contained to the USA, with other global markets such as Australia showing no change in the 2025 winter flu season when compared to 2024. Some of this is due to vaccine sceptic Health Secretary Robert F Kennedy Jr

- Seqirus Spin-out Paused: Due to the subdued vaccine market, CSL has decided to hold off on the Seqirus spin-out until market conditions improve to maximise shareholder value. Until the spinoff, Seqirus will operate independently from the main business. This is a good move in the current environment, with CSL wanting Sequirius to perform well once it begins trading on the ASX.

- Weaker Chinese Market: Chinese demand for albumin is expected to be weaker in the 1H amid the government’s cost-containment measures. CSL typically sells around US$1B in albumin annually to China, used in surgery and for the treatment of liver & kidney disease.

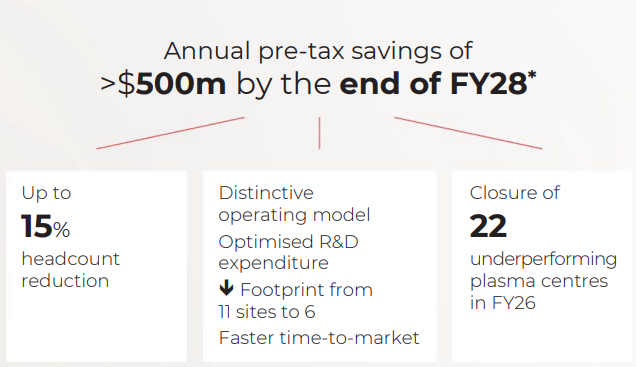

- Behring and Vifor Inline: Pleasingly, CSL provided an update that the other businesses, Behring and Vifor, are operating in line with management expectations, which will benefit from the cost-saving program over the next three years (see below).

- Guidance down: Following these moves, CSL downgraded earnings growth guidance for FY26 to +4-7%, from +7-10%. On this CSL is trading on a PE of 17x – a 20% discount to the ASX 200.

- Why is the stock down? The stock is down amid a subdued vaccine environment, which has led CSL to postpone the Seqirus demerger and downgrade earnings guidance. Whilst it is disappointing to see a poor vaccine environment, it only takes one terrible Northern Hemisphere flu season to see this business around. Atlas remains confident in CSL’s long-term prospects, with the cost-cutting program to drive earnings and the on-market share buyback restarting tomorrow.

Portfolio Strategy: CSL is a world leader in manufacturing medicines from human blood and flu vaccines, and, along with Sonic Health, are the Portfolio’s core healthcare positions. The business enjoys substantial barriers to entry with stable margins and, in Australia, enjoys exclusive rights to the production of blood plasma-derived medicines. The company earns over 90% of its profits offshore and benefits from a falling AUD. Key catalysts over the next 12 months will be 1) the continuation of the on-market share buyback, 2) the turn of the vaccine market and 3) the impact of CSL’s cost-cutting exercise, which is mostly complete and is expected to add US$500M per annum, consolidating the company’s R&D sites from 11 to 6.

CSL finished down -15% to $178.