This morning, Ampol (ALD), Australia’s largest energy distributor and retailer, released its full-year results for 2025. Their results were in-line with expectations, with a temporary refining closure offset by a strong underlying convenience retail business in Australia and New Zealand. The HNW Portfolios have a 4% weight to ALD.

Key Points:

- Profits Down: Ampol’s full-year profits were down to $235 million, driven by an unexpected closure of the Lytton refinery for maintenance during the second half . Convenience Retail earnings were up, driven by growth in shop margins from increased promotional mix. Z Energy in New Zealand continues proving it was a good acquisition, with earnings remaining stable throughout a more challenging economic environment boosted by jet fuels.

- Lytton Refinery: The refinery had a tough year with the combination of lower refining margins and unexpected outages weighing on earnings. To combat this, ALD took the lower refining margin time to turn off the refinery and perform additional maintenance, which will see no maintenance required on the refinery this year ahead of the upgrade to lower sulphur fuels at the end of the year. On the positive side ALD will see a cheque from the government in 2025 for $25.1 million to compensate ALD for the loss incurred in the Sept 2024 quarter.

- Balance Sheet: The Ampol balance sheet remains quite strong with net debt of $2.8 billion or 2.6x leverage, above the target leverage range of 2-2.5x. Ampol will naturally fall within the target range once Lytton profits return online.

- Dividend Down: ALD announced a fully franked 65 cents per share dividend, representing a lower payout ratio of 66% of profits. The dividend and payout ratio are expected to increase in 2025 with refining operating at full capacity.

- Outlook: Ampol management did not provide explicit guidance but did say that they are earning US$2 more per barrel of oil processed at Lytton refinery and that they are expecting to start the transition of Lytton Refinery to low sulphur fuels at year’s end. 2025 has started out strongly with refining margins 100% higher than in 2H 2024.

Portfolio Strategy: ALD is the core energy exposure in the Portfolio but with greater exposure to fuel and food retailing rather than the vagaries of the oil price. Over the past five years, ALD has changed from a capital-intensive business with volatile earnings dependent on global refining margins to one increasingly based on fuel and convenience retailing and bringing franchised service stations in-house. The return of suitors EG or ACT would be positive share price catalysts, especially with the government underwriting refining profitability and giving the company $125 million to improve their assets to produce ultra-low sulphur petrol. ALD trades on an undemanding = 9x forward earnings with a 5% fully franked dividend yield.

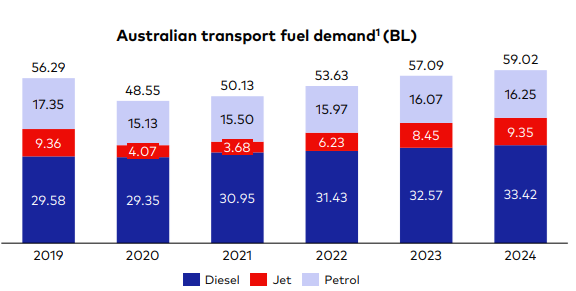

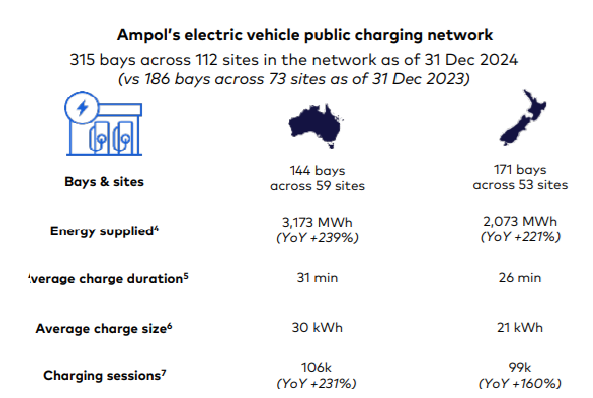

While EV penetration is increasing in Australia, in 2024 this represented only 8% of new car sales and 1% of passenger fleet. Australian fuel demand has continued to grow (slide below left), though ALD have made moves to capture revenue from EVs by installing fast chargers at 185 sites across Australasia, charging customers ~$50 to charge a Tesla while selling high margin cans of coke and ice blocks.

ALD finished down -2.5% to $27.31