This morning, Woodside (WDS) reported their full-year 2024 results, which came in above market expectations, helped by strong production at their new Sangomar project in Senegal. The HNW portfolios have a 4.5% allocation to WDS.

Key Points:

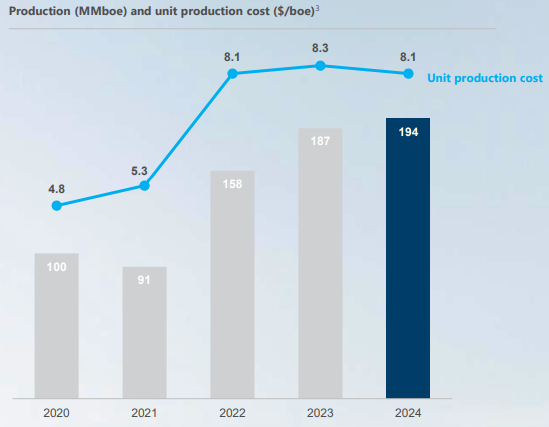

- Profit Down: Net profits of US$1.9 billion, representing a decrease of 13% on last year, driven by a 7% fall in realised LNG prices. Pleasingly, though, WDS saw record production of 194 million barrels of oil and lowered unit costs to US$8.10 a barrel, down from US$8.30 a barrel last year. (See Below). The profit margin of 70% reflects the high upfront capex but low ongoing costs of WDS’s large, long-life offshore projects.

- More Growth to Come: Over the year, WDS achieved its first oil at its Sangomar project in Senegal, adding 100,000 barrels of oil a day to Woodside’s Portfolio. In addition, WDS is still on schedule to deliver its Scarborough project in 2026 and the Trion project in the Gulf of Mexico in 2028, as well as the two acquisitions of the Tellurium LNG Terminal and Beaumont ammonia project. In line with other projects, WDS is looking to sell down stakes in these projects to offtake partners to both reduce the capital cost (and risk for shareholders) and to lock in customers, similar to the 25% sale of Scarborough LNG to LNG Japan for US$2.3 billion.

- Balance Sheet: Woodside maintains an extremely strong balance sheet, with 17% gearing below the midpoint of their target range of 10-20% gearing. This is very impressive when the company has heavily reinvested within itself for expansions whilst distributing high amounts of dividends.

- Dividends: WDS announced a full-year fully franked dividend of A$1.92 per share, representing an 80% payout of profits, boosted by a weaker Australian Dollar. Woodside highlighted that it would continue its current capital management framework of returning 50-80% of profits to shareholders over the medium term.

- Guidance: WDS did not provide any change on their guidance for 2024 but reconfirmed that they expect to produce 185-195 million barrels of oil. Texas Ammonia expects its first production in 2H 2025. Key news over the next six months will be an announcement of a sale of a stake in the Louisiana LNG export terminal. On the call, management said that they had fielded multiple offers from equity partners. A sell down of a stake in the US LNG export terminal will see a re-rating of WDS.

Portfolio Strategy: WDS is the Portfolio’s sole energy exposure and is the most conservative and well-managed Australian oil company. WDS has the lowest production cost and gearing, which is an essential position for an energy company as conditions are not always as sunny as they currently are. WDS has minimal exposure to the East Coast gas market, where politicians are floating legislation requiring these LNG producers to break long-term 20-year export contracts with Asian utilities to reserve gas for the domestic market, which faces supply constraints due to moratoriums on new gas projects in NSW and Victoria. WDS trades on a very undemanding PE of 12x with an 8% fully franked yield.

Woodside finished up +3% to $24.03