Incitec Pivot (IPL) Today, the global fertiliser and explosives manufacturer reported their full-year 2024 results, which were above market expectations. The HNW Portfolios hold a 3% weighting to IPL.

Key Points

- Solid Underlying Earnings: Earnings were up +18% to $580 million, driven primarily by a 45% increase in Dyno Nobels Asia and Pacific regions, which saw a record profit result and new contracts repriced higher. Dyno Nobels American operation saw a 15% increase in earnings following higher manufacturing reliability. The fertiliser earnings were mixed with record profits in distribution offset by a manufacturing shutdown in the first half. Second half manufacturing was solid with Phosphate Hill running at nameplate and gas costs lower.

- Solid Balance Sheet: The company has reduced debt by from $1.4 billion to $651 million with interest cover a solid 12.5x.

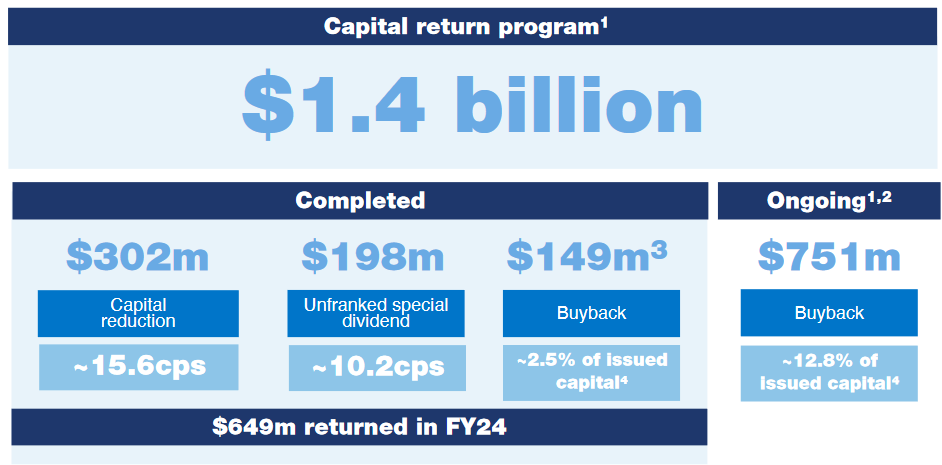

- Capital Management: IPL have been busy in 2024 returning $1.4 billion in capital to shareholders post the sale of Louisiana ammonia, this has seen 26.8 cents returned to shareholders in January and $149M of shares bought back on market (2.5% reduction in share count) – $751M of the on-market buy-back remains and will restart this week (13% reduction in share count).

- Dividend: IPL management announced a dividend of 10.6 cents.

- Strong Outlook: FY25 outlook looks solid for the company with higher prices for explosives globally. Trump’s return to the White House will likely see a rise in infrastructure, mining and construction spending increasing demand explosives particularly in quarrying which is high margin business for IPL in the USA.

IPL finished up 1c to $3.11 an 18-month high.

CEP Strategy: IPL is Australia’s largest manufacturer of fertilisers, supplying around 50% of the nation’s fertilisers. Additionally, IPL is the world’s second-largest manufacturer of explosives that are used in mining, quarrying and construction. IPL takes advantage of lower US natural gas prices via their new ammonia plant in Louisiana. IPL offers us exposure to a well-run global chemical company, benefiting from US shale gas, improving demand for Australian agricultural produce and a falling AUD. IPL is one of the last listed agriculture companies on the ASX, and HK-based activist investor Janchor now owns 9% of the company. IPL trades on a PE of 14x with a 3.5% yield. The company’s share price will see significant support over the coming year due to the size of the on-market buyback.